(This is an excerpt from an article I originally published on Seeking Alpha on July 21, 2015. Click here to read the entire piece.)

In several posts over the past few years, I have written about the many constraints binding the housing market. Based on recent news, the situation has yet to improve and has probably worsened. This is a good time for a quick review because the Federal Reserve is preparing to hike interest rates even as the housing industry is far from normalized. Surely one of the reasons the Fed has dragged its feet so far is that the housing industry remains nowhere near normal. Rate hikes could even serve to exacerbate some of the financing constraints that are still slowing down economic activity in the housing industry.

{snip}

- Not enough workers to make up slabs, pour slabs.

- Not enough framers.

- Not enough masons.

One consequence of this shortage is that a home built now is not as good as one built 10 years ago. This admission was quite surprising, but instructive!

{snip}

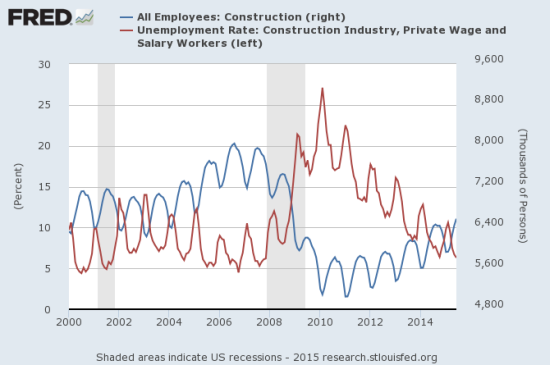

Source: US. Bureau of Labor Statistics, All Employees: Construction [CEU2000000001], retrieved from FRED, Federal Reserve Bank of St. Louis, July 21, 2015.

US. Bureau of Labor Statistics, Unemployment Rate: Construction Industry, Private Wage and Salary Workers [LNU04032231], retrieved from FRED, Federal Reserve Bank of St. Louis, July 21, 2015.

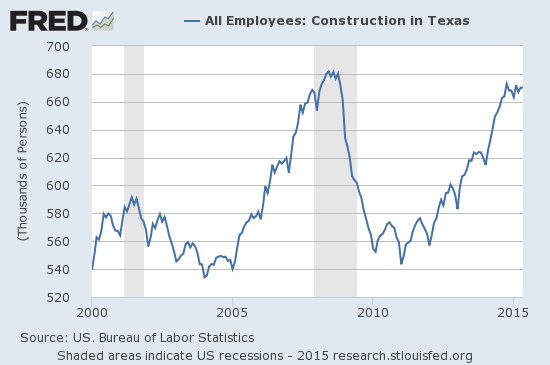

I have heard one theory that many of the lost construction workers are making better money in the oil and gas industry. If so, the current plunge in oil prices should push these workers back toward construction. Fed rate hikes could potentially make conditions even worse for the oil patch, particularly where a lot of debt and leverage is pulling oil out the ground. Yet, the oil-producing state of Texas has had no problem ramping construction back to pre-recession highs. Note that Texas still has one of the hottest housing markets in the country.

Source: US. Bureau of Labor Statistics, All Employees: Construction in Texas [TXCONSN], retrieved from FRED, Federal Reserve Bank of St. Louis, July 21, 2015.

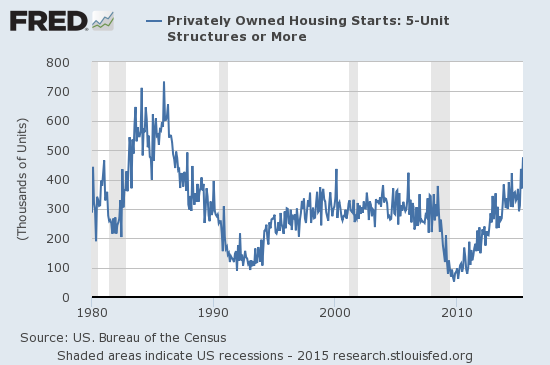

Another curious aspect to the labor shortage in the housing market is that multi-family construction (5 units or more) now sit at levels last seen in the late 1980s. {snip}

Source: US. Bureau of the Census, Privately Owned Housing Starts: 5-Unit Structures or More [HOUST5F], retrieved from FRED, Federal Reserve Bank of St. Louis, July 20, 2015.

{snip}

On July 20, the Wall Street Journal discussed constraints on the housing industry in “Bidding wars return to home market.” This piece’s anecdotes focused in on another of the U.S.’s hot markets: Denver, Colorado. Important financial constraints made the WSJ’s discussion.

{snip}

Higher rates will of course not help any of these financial issues and could, in a worst case scenario, hurt conditions further (perhaps only marginally however).

All these constraints mean that plenty of upside remains in the housing market, especially for the well-financed, publicly traded builders, as economic conditions improve ever so slowly over time. {snip}

Be careful out there!

Full disclosure: no positions

(This is an excerpt from an article I originally published on Seeking Alpha on July 21, 2015. Click here to read the entire piece.)