(This is an excerpt from an article I originally published on Seeking Alpha on May 20, 2014. Click here to read the entire piece.)

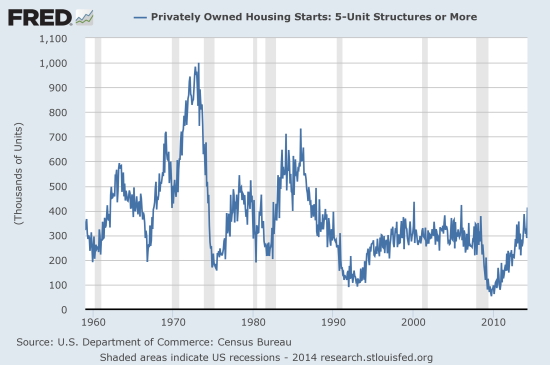

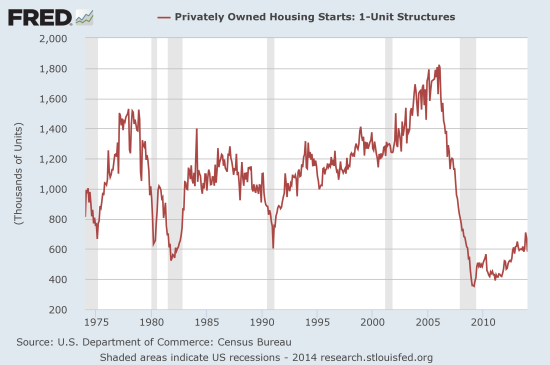

The U.S. Census Bureau and the U.S. Department of Housing and Urban Development (HUD) released on Friday the numbers for April housing starts. The continued increase in housing starts confirms the simultaneous and on-going ramp in employment for private residential construction.

{snip}

Source: St. Louis Federal Reserve

{snip}

Source: St. Louis Federal Reserve

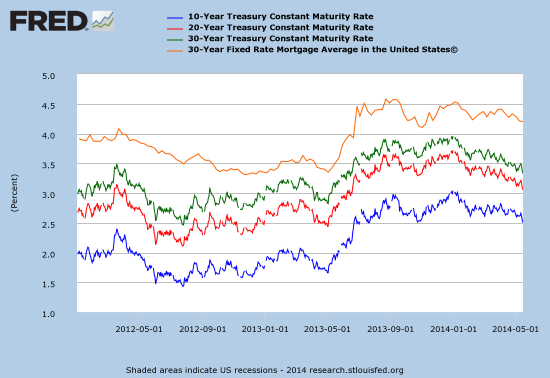

Interest rates are also supporting housing. Instead of increasing this year as expected, rates are on the decline. I assume that part of the trend was helped by Fed Chair Janet Yellen’s expressing concerns that housing has disappointed this year (at the last Joint Economic Committee, U.S. Congress). {snip}

Source: St. Louis Federal Reserve

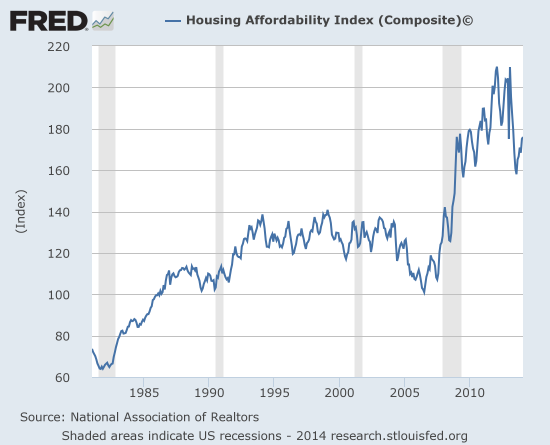

Declining rates also help housing affordability. The Housing Affordability Index plummeted last year when housing prices skyrocketed. Affordability has rebounded sharply since last September. {snip} Note that overall, housing still remains more affordable than it has anytime before the last recession going back to the 1980s. Detailed data on housing affordability are available from the National Association of Realtors.

Source: St. Louis Federal Reserve

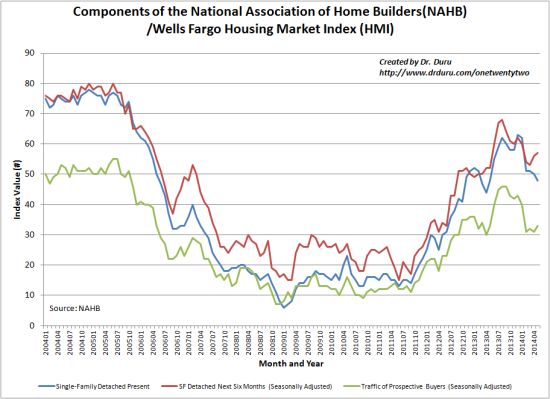

Finally, sentiment among home builders remains relatively stable. {snip}

/Wells Fargo Housing Market Index (HMI)

Source: National Association of Home Builders

{snip}

The on-going delay in housing formation is another upside risk as these delays are creating pent-up demand. However, increasing student debt is the next looming headwind for new household formation. A recent blog posted at the New York Federal Reserve’s Liberty Street Economics titled “Young Student Loan Borrowers Remained on the Sidelines of the Housing Market in 2013” shows that not only has home ownership declined for 30-year olds, but also the rate of ownership has declined more sharply for 30-year olds with student debt. {snip}

There are many other slices to these data that warrant unpacking, but the overall message appears to be that, to an increasing extent, young people who incur debt for their education are becoming less able (and/or willing) to take on home mortgages than their counterparts with no such debt. {snip}

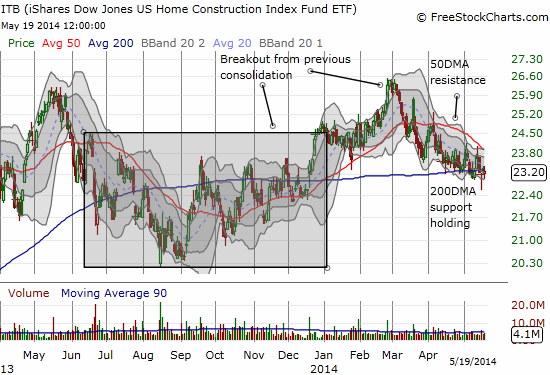

This confluence of signals provides interesting challenges for investors in home builders. If I am correct that the balance of risk is to the upside, it makes sense to wait out the current churn and growing stalemate. {snip}

The iShares US Home Construction (ITB) is a good place to “sit and wait.” {snip}

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long ITB call options

(This is an excerpt from an article I originally published on Seeking Alpha on May 20, 2014. Click here to read the entire piece.)