(This is an excerpt from an article I originally published on Seeking Alpha on March 2, 2014. Click here to read the entire piece.)

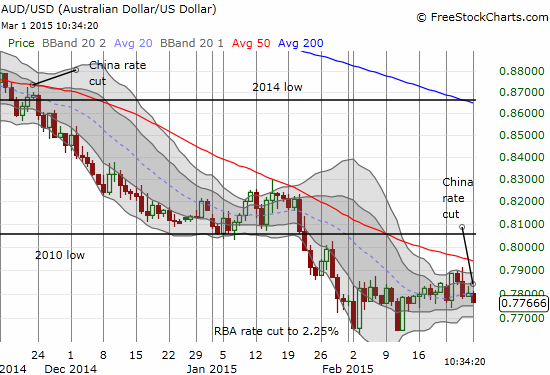

On Saturday, the People’s Bank of China cut its benchmark interest rates by 0.25 percentage points (25 basis points). Yet, as of the open of Asian trading, the Australian dollar (FXA) failed to respond as usual with a trigger rally. When China cut rates on November 21, 2014, the Australian dollar received a quick boost higher. Of course, the pop did not last long, and the Australian dollar preceded to descend along its the next big leg lower. The market may have taken a lesson from that experience – this time there is no such pop in the Australian dollar (so far).

Source: FreeStockCharts.com

{snip}

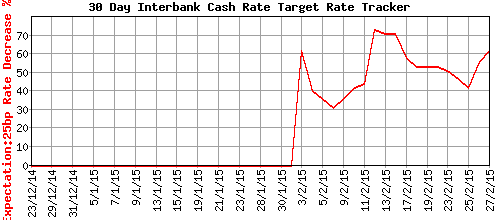

Source: ASX RBA Rate Indicator

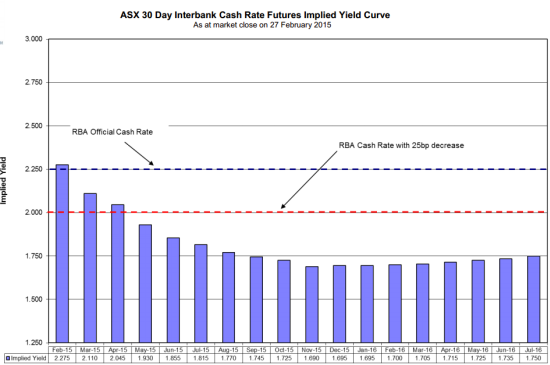

After February’s rate cut, the Australian dollar plunged as the move appeared to catch enough traders by surprise. However, the Australian dollar has yet to trade lower. In fact, the currency soared the very next day to produce a four (trading) day high. Given this inability to trade lower ever since, I am not nearly as confident as last time around that an RBA cut will send the Australian dollar to new lows. {snip}

Source: ASX RBA Rate Indicator

Be careful out there!

Full disclosure: net short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on March 2, 2014. Click here to read the entire piece.)