(This is an excerpt from an article I originally published on Seeking Alpha on January 15, 2015. Click here to read the entire piece.)

The Swiss national Bank (SNB) curtly reminded me that paper currencies are just the playthings of central banks.

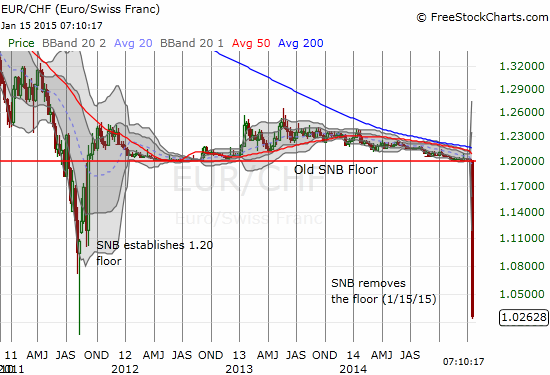

Just over a week after I had start enjoying more actively shorting the Swiss franc (FXF), the Swiss National Bank dropped a bomb on financial markets by announcing it will pull the rug from under the EUR/CHF by removing the 1.20 artificial floor. The impact was immediate and dramatic.

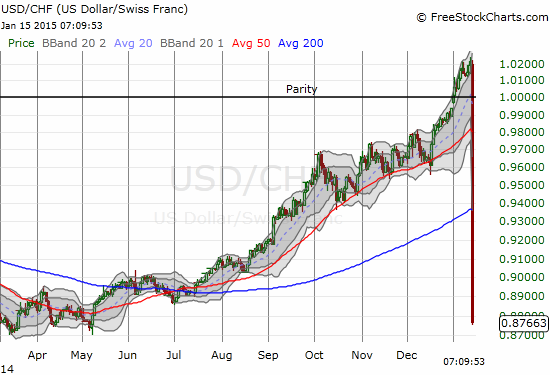

Source for charts: FreeStockCharts.com

The SNB’s capitulation comes with a few vain attempts to smooth over this dramatic change in monetary policy. First, the SNB moved its range on three-month Libor further to –1.25% to −0.25% from −0.75% to 0.25%. {snip}

{snip}

Next up, the SNB suggested that it is really its exchange rate against the U.S. dollar that provided the final trigger on this decision:

{snip}

This is a euphemistic way to refer to capitulation. {snip}

Finally, the SNB makes a hopeful stab at guessing that more deeply negative rates will prevent an over-tightening of monetary conditions. {snip}

This surprise move exposed a severe weakness in my trading strategy. {snip}

As it stands, my exposure was thankfully relatively small as I was just in the beginning process of rebuilding positions short the franc. {snip}

This whole episode reminds me of my own warning about the potential for more wild currency moves when I wrote “Parabolic Moves In The Ruble And Turkish Lira May Foreshadow The Same For The Australian Dollar.” Anyone got gold…?

Be careful out there!

Full disclosure: short franc

(This is an excerpt from an article I originally published on Seeking Alpha on January 15, 2015. Click here to read the entire piece.)