(This is an excerpt from an article I originally published on Seeking Alpha on January 5, 2015. Click here to read the entire piece.)

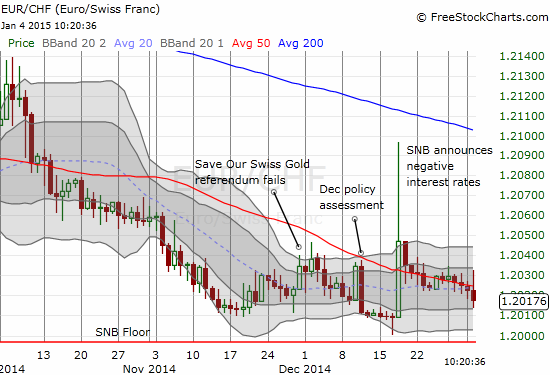

Don’t look now, but the Swiss franc (FXF) is seemingly back for another test of the 1.20 currency floor against the euro (FXE).

When the market forced the hand of the Swiss National Bank (SNB) to take additional measures to weaken the franc, the SNB rolled out negative interest rates. As the chart above shows, the impact was immediate, yet the market’s preference to fade the weakness was also immediate. {snip}

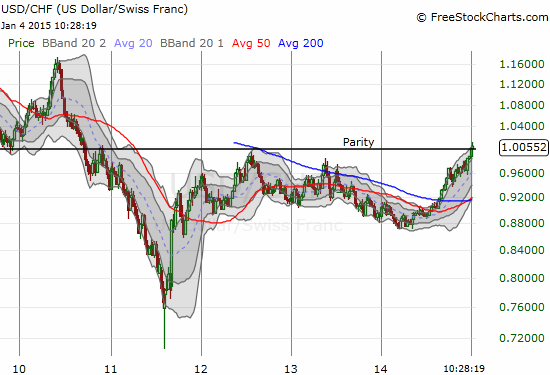

In the meantime, the Swiss franc IS continuing to weaken against the U.S. dollar (UUP) – so much so that the USD/CHF currency pair returned to parity to start off 2015.

This weekly chart suggests that the U.S. dollar is breaking out against the Swiss franc and can very easily rally to highs last seen in 2010. {snip}

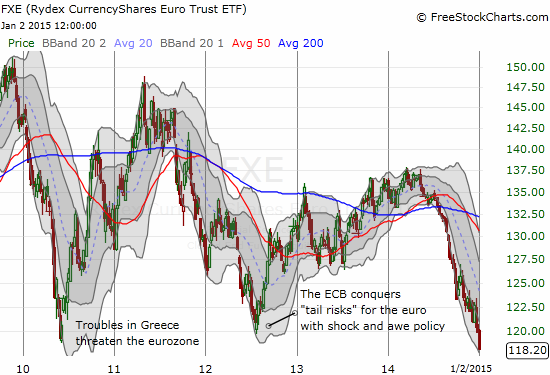

These dynamics now make me prefer shorting the Swiss franc over shorting the euro. For example, it is very possible that the next monetary policies out of the ECB instill enough confidence in the market that traders start bidding the euro UP in anticipation of better days ahead. In such a case, EUR/USD becomes an amazing, contrarian play. But this will still leave the SNB unsatisfied if EUR/CHF stays just as low as ever with the franc bid up in sympathy. In other words, the onus of weakness seems to lie now much more heavily on the franc than the euro. Time should soon tell.

Source for charts: FreeStockCharts.com

Be careful out there!

Short the euro, franc; long the U.S. dollar

(This is an excerpt from an article I originally published on Seeking Alpha on January 5, 2015. Click here to read the entire piece.)