(This is an excerpt from an article I originally published on Seeking Alpha on September 21, 2014. Click here to read the entire piece.)

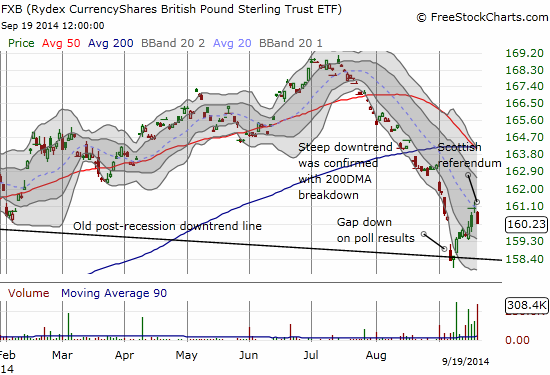

The people have spoken…and so apparently have the markets. The people of Scotland voted firmly in favor staying within the United Kingdom. In response, the British pound (FXB) sank sharply, defying some expectations that the currency would soar on a NO vote. Essentially, that rally may have already happened.

It is not possible to know for certain what explains the pullback in the British pound, but there are several clues available for investigation. It all starts with the gap down on September 8th in the wake of poll results which suddenly suggested that the Yes campaign had much improved odds of winning.

{snip}

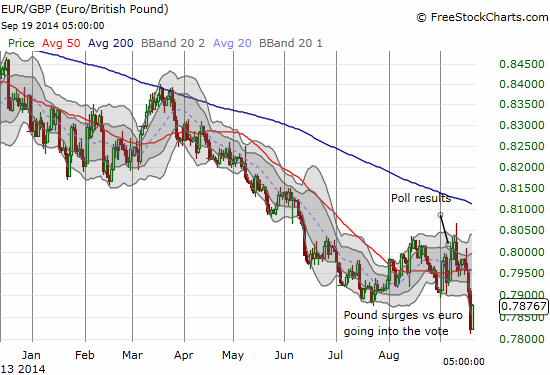

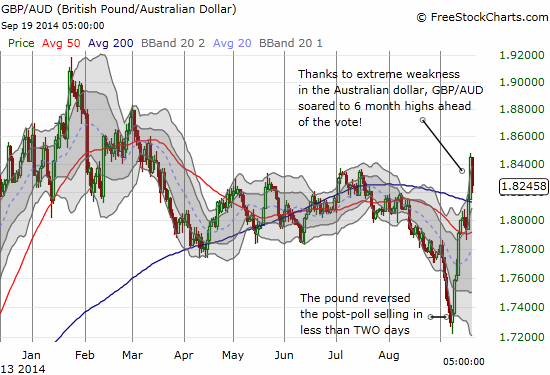

This story is of course ex post (after the fact), and it fits what I can observe now with hindsight. {snip} However, the market’s relative comfort with the British pound was VERY evident and obvious against other major currencies I follow: the euro (FXE), the Japanese yen (FXY), and the Australian dollar (FXA). In each case, the British pound reversed its losses within days and achieved major milestones AHEAD of the referendum vote. {snip}

Source for charts: FreeStockCharts.com

Sure each currency pitted against the British pound pair has its issues, but the market definitively stated with these observable moves that it was quite comfortable that the British pound was not in trouble from the results of the referendum. {snip}

I do not expect the British pound to immediately resume its pre-vote rally. {snip}

{snip}

So now back to the election results and some lessons learned when trying to tie real-world headline/event risk to currency trading. The market definitely had this one right in the days going into the vote: the final result was never even close or in question. {snip}

{snip}

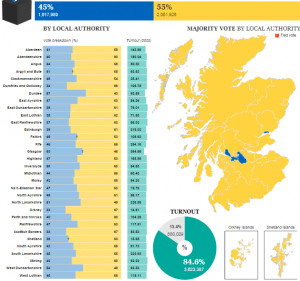

Click for larger view…

Source: The Telegraph

Given these results, another question to ask is how did the YES camp get over-estimated in the final two weeks? {snip}

Re #ScotlandIndependence #polls, assume most undecideds will be "No" (not evenly divided as UK pollsters think). I predict Yes-45/No-55.

— Patrick Murray (@PollsterPatrick) September 12, 2014

Whatever the reason, a big lesson and reminder I have taken from this episode is that it typically pays to follow the money. {snip}

Be careful out there!

Full disclosure: net short the British pound

(This is an excerpt from an article I originally published on Seeking Alpha on September 21, 2014. Click here to read the entire piece.)

Now you get it…

http://news.yahoo.com/katie-couric-scottish-independence-now-i-get-it-195951504.html;_ylt=AwrTHRoc8RtUyFwAD4RXNyoA;_ylu=X3oDMTEzMmcwdGpzBHNlYwNzcgRwb3MDMwRjb2xvA2dxMQR2dGlkA1NNRTY5OV8x