(This is an excerpt from an article I originally published on Seeking Alpha on July 16, 2014. Click here to read the entire piece.)

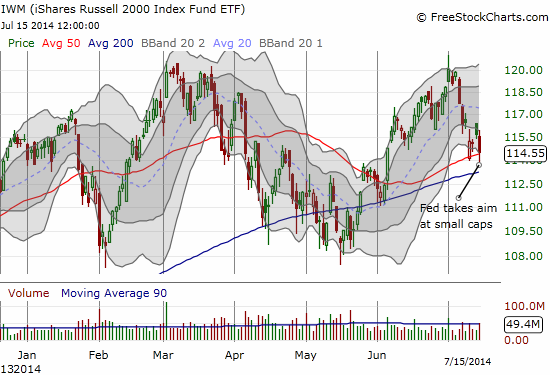

On July 15th, the Federal Reserve released its latest Monetary Policy Report as a part of Chair Janet Yellen’s testimony before the Senate’s Committee on Banking, Housing, and Urban Affairs. The report covers recent econonmic and financial developments, monetary policy, and a summary of economic projections. The report includes a sidebar on financial stability in the U.S. The Federal Reserve used this section as an opportunity to identify parts of the stock market showing stretched valuations:

“Equity valuations of smaller firms as well as social media and biotechnology firms appear to be stretched, with ratios of prices to forward earnings remaining high relative to historical norms.”

Leading into this sidebar, the Fed appeared to take a swipe directly at social media and biotechnology stocks (emphasis mine):

{snip}

{snip}

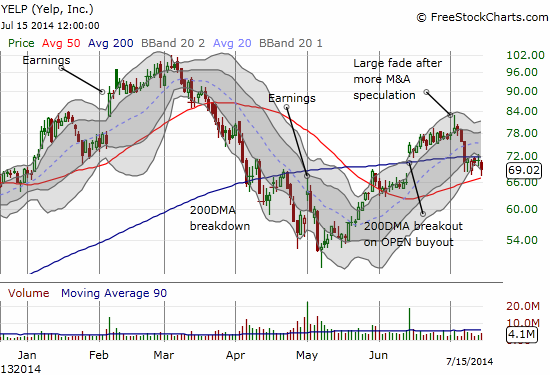

Valuations in many social media stocks are indeed high. A month ago, I looked at valuations of internet-related companies based on price-to-sales ratios, some of which fall into the small-cap or “smaller firm” category for social media, to point out that the Priceline Group (PCLN) deal for Open Table (OPEN) helped to calibrate valuations for this space. {snip}

Source for all charts: FreeStockChart.com

I also mention YELP because CNBC’s Jim Cramer used the stock to highlight the Fed’s statement on social media valuations in “Cramer: Janet Yellen saying short Yelp?“. Cramer recommended that the Fed target margin rates to extremely high levels rather than target specific stocks to bring valuations down. However, I think he hit the wrong point. The Federal Reserve was not making a call to action. {snip}

(This is an excerpt from an article I originally published on Seeking Alpha on July 16, 2014. Click here to read the entire piece.)

Be careful out there!

Full disclosure: no positions