(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 59.1%

VIX Status: 12.1%

General (Short-term) Trading Call: Hold (Bullish)

Active T2108 periods: Day #303 over 20% (includes day #280 at 20.01%), Day #17 over 40%, Day #14 over 50% (overperiod), Day #2 under 60%, Day #43 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

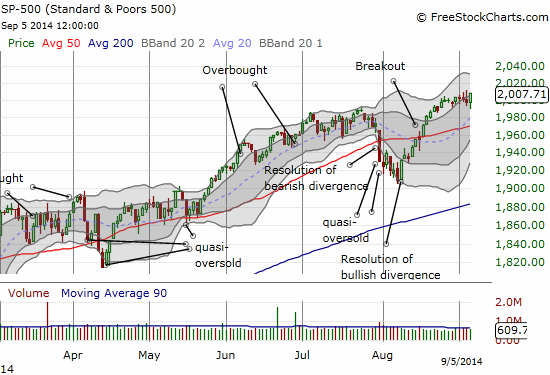

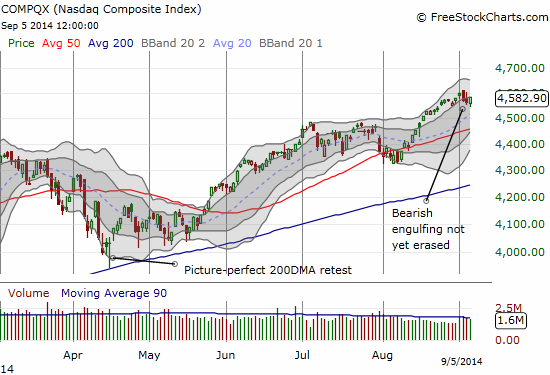

Market conditions turned a bit ominous at the close of trading on Wednesday, September 3rd. I was on the lookout for follow-through. Sure enough, the next day, sellers were able to send the S&P 500 (SPY) and the NASDAQ (QQQ) down again, even if marginally. In particular the NASDAQ broke its primary uptrend by closing below the first Bollinger Band (BB). On Friday, the S&P 500 came roaring back from initial selling to close with a fresh all-time closing high. The NASDAQ suddenly found itself slightly under-performing as its comeback did not wipe out the bearish read from Wednesday.

This is what I call a close call. On Friday morning, I was mentally writing an incrementally more bearish stock market update. Instead, I am now writing a mixed piece that maintains the bullish bias in the trading call. There is one caveat: T2108 is still well off its recent high for this cycle.

T2108 closed at 59.1%. It was as high as 65.5% on Wednesday before the market faded. This behavior is not a bearish divergence because T2108 closed with a gain, not a loss. What has my attention right now is T2108 lagging the S&P 500. The lagging takes on more weight with the NASDAQ’s performance and loss of its primary uptrend. It is not likely such lagging can persist for long without the S&P 500 reversing, so I am “on alert.”

Finally, traders must pay closer attention to currency markets if they have gotten in the habit of ignoring them. I wrote a related piece called “The U.S. Dollar Is Strong But…What About Carry?” In particular, the ECB’s push to ramp up liquidity in the eurozone economy provides a fresh source of funds to fuel more trades, more investments, and even less volatility. Weary bears are facing an army with supply lines restocked, re-fortified, and ammunition for as far as the radar can see. I think the resolution of these new battle lines will become pretty apparent in the coming weeks. Stay tuned.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: no positions