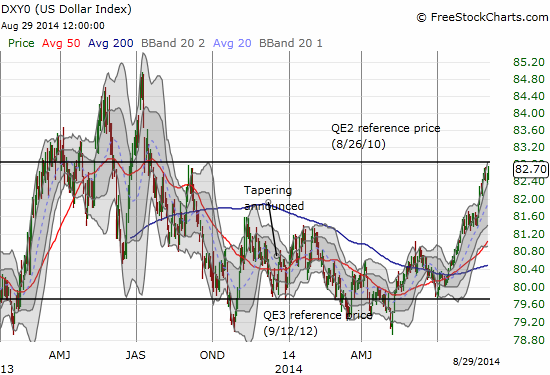

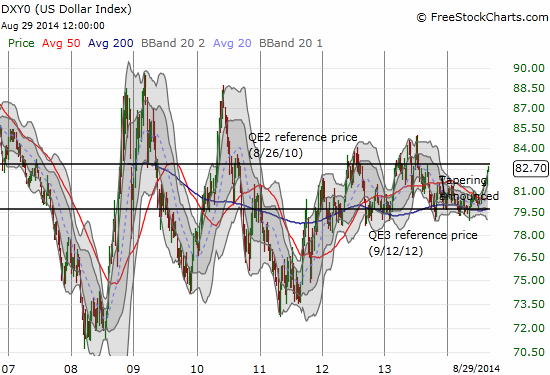

Ten days ago, I thought the U.S. dollar (UUP) was over-extended and due for a correction. A cooling never happened. Instead, the dollar index continued climbing the upward trending channel between the first and second Bollinger Bands (BBs). Now, the dollar index faces an even more critical test: the presumed ceiling of a trading range that has held firm since last summer. This cap is somehwat stylized. I created it using the dollar index’s closing price after Federal Reserve chairman Ben Bernanke pre-announced QE2 on August 26, 2010 at Jackson Hole, Wyoming.

Source: FreeStockCharts.com

Even though the dollar index managed to break above the QE2 reference price several times, the rallies never lasted long. So, I still like to think of this level as a cap.

This critical test is all the more critical with the European Central Bank (ECB) on-deck for a monetary policy decision featuring pressure from France in the form of Prime Minister Manuel Valls demanding that the ECB do even MORE to get the euro lower. France is fighting against renewed recessionary pressures. Valls made a similar demand back in May ahead of the ECB taking additional extraordinary measures. Given the euro is slightly more than 50% of the dollar index, moves in the euro will most directly influence the dollar’s critical test.

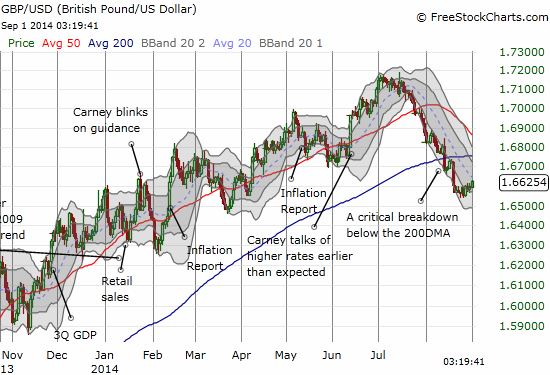

I am most interested in the possibility for the British pound to make a comeback against the U.S. dollar. It has been on a massive slide against the U.S. dollar for almost six weeks. This slide seems well over-done given the strong economic fundamentals in the UK that should not be impacted by the upcoming referendum in Scotland on independence. Note well though that GBP/USD faces major looming overhead resistance from a now declining 50-day moving average (DMA) and a 200DMA which is now flattening…

Source for charts: FreeStockCharts.com

I am sure sometime in September I will be assessing whether or not GBP/USD can resume its previous uptrend.

Be careful out there!

Full disclosure: long and short the U.S. dollar versus various currencies, long GBP/USD

Nwanne,

Hope u are fine.

I expect USD to still get to $85 b4 any meaninful pullback on this leg. GBPUSD looks towards 16000 on this second leg. Remains sell on the rally. My own opinion & trade though 🙂

My knee-jerk reaction to the news about potential Scottish independence was that currency markets will adjust to reflect market dislike for unpredictable outcomes – thereby creating a trade opportunity for those who believe they know the outcome.

I’m curious why you think Scottish independence would not affect the UK’s economy. As a thought experiment, it seems to me that if Quebec seceded from Canada (an actual possibility, as opposed to, say, a US state seceding from the USA) it wouldn’t instantly devastate Canada’s economy (since most existing business relationships would continue and only gradually adjust to reflect the new political relationship), but it would surely have some discernible immediate effects, and more over time as those who had desired secession exploited it.

I can’t argue with trends until they change! 🙂

That’s a good point. I was assuming that existing businesses have every reason to try to continue operating without disruption. I am also thinking of London as the economic center, but after further thought (and reading), I am realizing I am not giving Scotland enough credit! I guess I better hold onto my seat.