(This is an excerpt from an article I originally published on Seeking Alpha on June 14, 2014. Click here to read the entire piece.)

Recent research provide additional color to the last entry in my on-going series on Baby Boomers and the housing market: “Cash Buyers And Optimism Counter The Notion Of An Imminent Housing Crisis Triggered By Baby Boomers.”

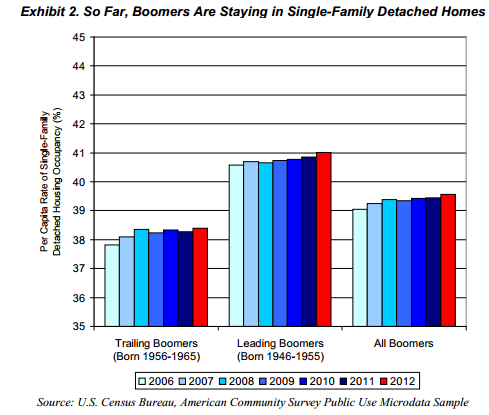

On June 12, 2014, Fannie Mae released a study titled “Are Aging Baby Boomers Abandoning the Single-Family Nest?” This kind of research is an important starting point to understand how the aging of Baby Boomers will impact the gradual transfer of their housing wealth to the next generations. Pessimists fear that this transfer will help trigger a collapse of the housing market through dislocations in supply (too large) versus demand (too small). I have been claiming that such pessimism is overdone and misdirected. The Fannie Mae study is valuable because it delivers hard data that counters popular assumptions that Baby Boomers are automatically downsizing after their homes empty of children:

{snip}

Source: Fannie Mae

The current data are suggestive but what can be said about the potential future? {snip}

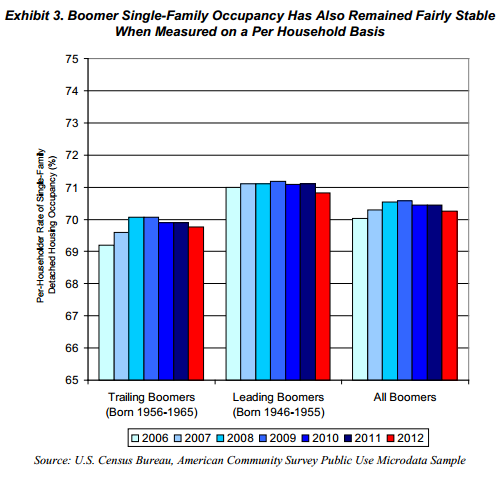

Jed Kolko, Chief Economist of Trulia (TRLA), took Fannie Mae’s research one stop further to try to answer the question on future downsizing (it was Kolko’s article that pointed me to the Fannie Mae research). Kolko used trends in residency for multi-unit housing to suggest that Boomers will indeed not be moving en masse anytime soon…at least not to the traditional targets of downsizing in apartments and condos:

{snip}

Source: Trulia

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 14, 2014. Click here to read the entire piece.)

Full disclosure: no positions