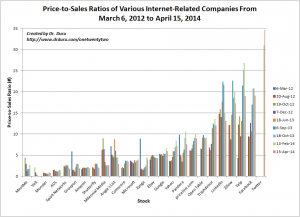

Here is a very quick tax-day valuation update on select Internet-related stocks. The ordering of stocks by price-to-sales (P/S) ratios did not change much but several stocks have retreated off their most stretched valuations. However, nothing that WAS “expensive” has suddenly become “cheap” now…

Click image for details…

Source: P/S data from Yahoo Finance

{I am also just realizing that I have not been including Netflix (NFLX)! It has a P/S ratio of 4.53, placing it smack in the middle of the pack right now}

Be careful out there!

Full disclosure: short FB, long FB call spread, long TWTR, long AMZN, long LNKD, long NFLX call spread, long ZNGA, long MM (note well, still bearish overall the market. All the long positions here are very speculative plays on an eventual bounce even as I continue buy puts on QQQ, calls on QID, and fade bounces on other high-flying tech/internet stocks. FB short is now a bet that it has topped. Long ZNGA and MM are leftover disasters!)