(This is an excerpt from an article I originally published on Seeking Alpha on February 10, 2014. Click here to read the entire piece.)

After writing about the bullish earnings report from D.R. Horton (DHI), I have looked for further confirmation from other major public homebuilders. Meritage Homes (MTH) remains on my list of favorites to study (and hopefully soon to buy). However, unlike DHI, MTH was more cautious and measured in its earnings report on February 5, 2014 when expressing the company’s optimism for the spring selling season and the rest of 2014. MTH also provided forward guidance of “flattish” expectations for margins this year.

Like most builders, MTH once again reported outstanding year-over-year results. The market clearly no longer cares about such results as the stocks have generally priced in this kind of performance. Now, it is all about the future and guidance. {snip}

{snip}

An analyst on the call asked about the lack of guidance beyond margins. MTH referenced the slower pace of sales in the second half of 2013 as a reason to “wait and see what happens to the next couple of months with the kickoff of the spring selling season.” The company reassured analysts that it is “cautiously optimistic”; more detailed guidance will come next quarter. MTH also explained that the slower sales pace was partially due to a decision to raise prices where selling pace was far above expectations. {snip}

This elasticity will be closely watched this season. {snip}

Moreover, MTH acknowledged in response to a question on home inventories that builders have responded to the strong demand for housing by ramping up and making sure they have inventory available for this spring’s selling season…{snip}

So the stakes are high (again) for the spring selling season. Homebuilder stocks are likely to be particularly volatile during this period as traders, investors, and analysts all try to interpret and extrapolate every single piece of data on housing during this period and act quickly on these rapid fire assessments. I expect to use any premature negative assessments as buying opportunities.

Further supporting the notion that 2014 will be a more “normal” year, MTH provided further color on margins by referencing an expectation for business to return to more normal seasonality:

{snip}

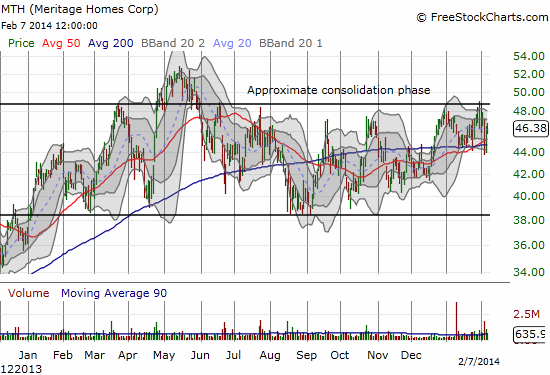

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 10, 2014. Click here to read the entire piece.)

Full disclosure: long DHI