(This is an excerpt from an article I originally published on Seeking Alpha on November 4, 2013. Click here to read the entire piece.)

The National Association of Homebuilders (NAHB) issued an important summary of recent economic and political news relevant to housing titled “Eye on the Economy: Slowing Sales.”

Here are the key points that I took from the assessment:

{snip}

The NAHB report also touched on the potential for politics and legislation to impact the housing recovery. This is an area I have not watched closely to-date. However, the expiration of numerous rules requires close attention.

{snip}

{snip} Perhaps most importantly, November will likely feature discussion of tax reform that could include the deduction for interest on home loans and property taxes. {snip}

In a separate post and interview, Jerry Howard, CEO of the NAHB discusses what is at stake with the coming legislative agenda. Howard emphasizes the dysfunctional aspect of the situation…{snip}

That something may be on housing finance reform…{snip}

Howard pointed to two pieces of legislation of interest.

{snip}

Clearly, forces are moving to reform the way mortgages are financed in the U.S. What matters for homebuyers and investors in homebuilders is whether any changes tend to increase or reduce competition amongst lenders and whether loans become less or more available. It is too early to place bets either way, but these developments warrant close monitoring.

The current legislative agenda addresses just one part of the platform on housing that President Obama took on tour starting in Phoenix, Arizona on August 7, 2013. It is part of the “Better Bargain for the Middle Class, and he calls it “A Home to Call Your Own.” Specifically, Obama indicated that he wants to wind down Fannie and Freddie. As a replacement, he set out the following principles:

{snip}

{snip} The Corner-Warner bill in the Senate and the PATH Act in the House will be key litmus tests of Congress’s appetite for tackling these tough issues.

As a reminder, here is the rest of Obama’s agenda which he hopes will help to “turn the page on the bubble and bust mentality” in the housing market…

{snip}

The refreshing part of this agenda is that it does not seek the impossible mission of pleasing buyers with cheap housing and homeowners with soaring home values. This more pragmatic view showed up in Obama’s following interview with CEO Spencer Rascoff from Zillow (Z). {snip}

In this interview, Obama went on to acknowledge that most advanced economies in the world do not have as heavy government involvement in the mortgage market as the United States does. {snip}

No matter how this entire housing agenda plays out in political reality, I think it is important to recognize that the shadow of the housing bubble looms large over the political discussion of reform in the housing market. A housing agenda that includes a discussion of rental options is a welcome diversification in thinking. {snip}

{snip}

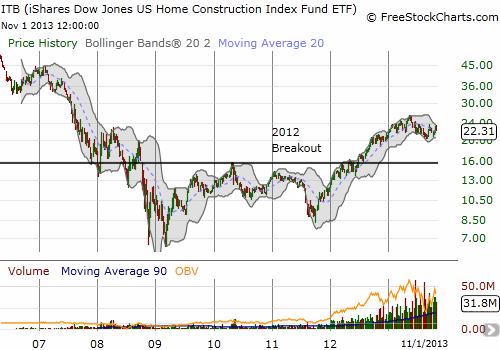

Click image for larger view….

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 4, 2013. Click here to read the entire piece.)

Full disclosure: no positions