(This is an excerpt from an article I originally published on Seeking Alpha on June 13, 2013. Click here to read the entire piece.)

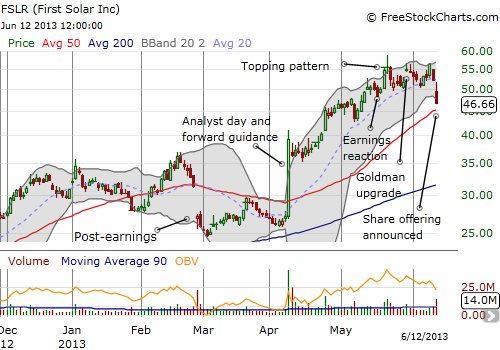

First Solar (FSLR) has run an “intriguing” script since making an all-time low last August…

{snip}

The offering of shares is of course well-timed given the run-up. With its currency this high, FSLR can afford to generate and bank additional cash to invest in its future. During its April analyst day, the company announced it is re-committing itself to fundamental R&D. FSLR expects to widen the gap between itself and its heavily indebted competitors who will continue to struggle to repair their balance sheets. This extra cash allows FSLR to turn up the heat further and/or slog through any further setbacks in the global economy.

For investors and traders chasing momentum ever higher, the immediate outlook is not so hot. {snip}

Also telling is the behavior of trading in FSLR options. {snip}

So, even as the stock is breaking down, I do not expect shares short to increase rapidly. Instead, the action in puts may heat up. {snip}

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 13, 2013. Click here to read the entire piece.)

Full disclosure: long FSLR put spread