Many internet-related stocks have been on fire lately. In many ways, the run-up has been about mobile, so it may not even be technically accurate to call this feature a valuation update on internet-related stocks. Regardless, the most notable change since the last update in mid-June is that the internet high-fliers have experienced significant run-ups this summer. Facebook (FB), Yelp.com (YELP), LinkedIn (LNKD), and Zillow (Z) experienced significant surges over the past 3 months.

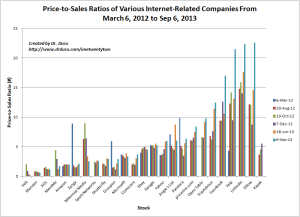

Click the chart below for a larger view of the price-to-sales (P/S) ratios of select internet-related stocks. The chart is ordered from left-to-right by the latest P/S ratio. (This will be the last update to include Kayak. It is off to the right and not included in the P/S ordering). As a reminder, I use P/S ratios instead of P/E so that I can compare profitable and unprofitable companies.

Source: Yahoo Finance

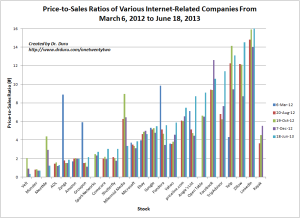

For comparison purposes, here is the chart from the last update (again, click for a larger view):

There are no major or dramatic changes in the ordering of the stocks. Pandora has moved up a few slots. FB has moved up one slot.

I am honestly amazed, even baffled, at the market’s willingness to keep running up the valuations on these stocks. I believe price momentum has largely taken over, and as long as this momentum is in play a lot of money can be made continuing to play for more upside. Facebook has the added advantage of a very positive news cycle with analysts delivering major upgrades and with growing excitement over FB’s ability to monetize mobile users and video ads. Facebook’s latest upgrade was just this past Friday (September 6th) by Sun Trust Rbsn Humphrey which increased its price target from $40 to $55.

Here is a quick rundown of how I have been playing some of these stocks:

Facebook (FB)

As noted in earlier posts, I am slowly building a short position in anticipation of an eventual sell-off. My original $20 target for 2013 is very unlikely, so I am now positioning for 2014 (yes, I am so relieved I covered my last short position in early June – it magically turned out to be THE bottom for 2013. See “Sentiment Clinic: Facebook STILL Bullish” for more details on the trade). In the meantime, I have been loading up on call options to play the current momentum. The first round yielded a double. The second round ended on September 6th with a double on my first tranche and a quadruple on the second tranche (I doubled down on my call options when FB experienced a now rare pullback).

The obvious question is if trading call options is so incredibly profitable on FB why bother shorting? My answer is that when the market’s euphoria takes off, there is simply no telling when the spigot of emotion turns off. It can happen overnight; it could be an unanticipated blip in an earnings report. I just want to be in position whenever it happens. The profits on the call options pay for the position while I wait. With the current momentum, FB has been surprisingly easy to flip…and the out-of-the-money call options STILL look relatively cheap to me.

Bottom-line: FB has turned from goat to gloat as it has pulled off the rare feat of a full recovery from a busted IPO of historic proportions.

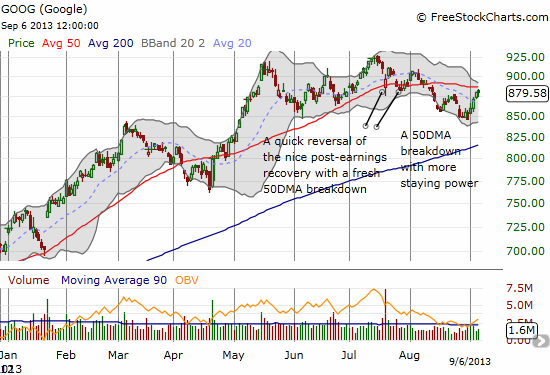

Google (GOOG)

Google has been a disappointment. I was forced to turn from bullish (yep, I had a $1000 price target by year-end) to a bear just based on the technicals. The stock looks like it is churning through a major breakdown. I went after my first bearish position on Thursday’s rush toward 50-day moving average (DMA) resistance. A close above the 50DMA turns my sentiment around again. Beating August’s high will get me dreaming about the $1000 price target again…

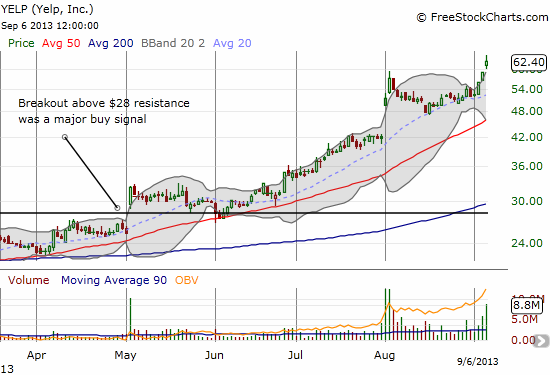

Yelp.com (YELP)

YELP has become my “guilty pleasure.” I have come to really appreciate the service over the past year or so, and I have been trading it from the long side for most of this year. I did a poor job of announcing my change of heart from bear to bull when I simply provided a disclosure in a February piece bearish on Facebook (see “For Facebook, Market Sentiment Has Changed More Than The Business Has“). Prior to this, I had focused on Yelp’s consistent inability to break through resistance around $28. I also did not (and do not) like the high valuation on a company that makes such small profits with an unclear growth path.

I sold my latest round of call options into Thursday’s pop. I missed Friday’s impressive surge above the upper-Bollinger Band on the heels of upgrades from Barclays to overweight and a mind-boggling price target from Deutsche Bank at $81 (rating is “just” a buy). I think the stock is ridiculously over-valued: forward P/E of 260 and a $4B market cap! Yet, I have chosen not to fight this one as long as the momentum is so friendly. I can’t be bearish about every over-valued stock, right? Besides, my wife and I have discovered some incredible Thai restaurants using Yelp…

Source for charts: FreeStockCharts.com

Full disclosure: short FB, long put spread GOOG, long YHOO, long Z puts, long MWW

Be careful out there!