(This is an excerpt from an article I originally published on Seeking Alpha on May 15, 2013. Click here to read the entire piece.)

{snip}

In Bubble Watch, Trulia Chief Economist Jed Kolko, Ph.D. explains that housing is not back in bubble territory based on incomes (which determine how much people can pay), rents (which determine “…how much people value housing even if they won’t benefit from price appreciation”), and historical prices which provide an anchor for assessing trends. {snip}

Putting it all together, Kolko estimates that nationwide, U.S. homes are still 7% undervalued. Ninety-one of America’s 100 largest metro areas remain undervalued. Of course, since real estate markets are local, these aggregated statistics hide some important extremes. Cities like Las Vegas, Detroit, and Cleveland are undervalued by -20% or worse. Four of the top seven overvalued cities/regions are located in California. The other three are in Texas.

{snip}

Source: Trulia Bubble Watch for May, 2013

I also checked out Trulia’s rent versus buy calculator. According to Trulia’s model, there is not a single metro area in the country where it is cheaper to rent than buy, not even in California or Texas. {snip}

So, overall, there is no housing bubble in the U.S. Kolko expects housing demand to soon cool down as prices continue to rise, investors lose interest as cheap properties become more scarce, and interest rates go up. {snip}

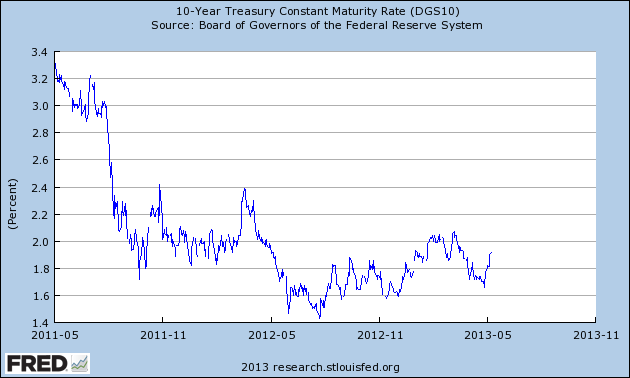

Speaking of interest rates, rates crept higher over the past two weeks. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 15, 2013. Click here to read the entire piece.)

Full disclosure: no positions