(This is an excerpt from an article I originally published on Seeking Alpha on August 15, 2013. Click here to read the entire piece.)

In last week’s Inflation Report, Bank of England governor Mark Carney tried his best to spin the good economic data in the United Kingdom as evidence that interest rates need to stay low. The current recovery is gaining momentum, but it is nowhere close to where it needs to be:

{snip}

With unemployment still high, the Bank of England, through the Monetary Policy Committee (MPC), wants to maintain low rates for the economy even as economic conditions improve. To this end, the MPC established forward guidance for policy to reassure markets of the accomodative policy presumably required to keep the economy on a sound footing:

{snip}

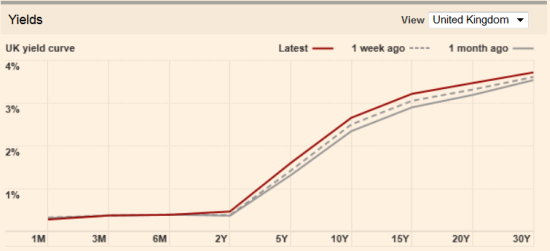

The chart below from The Financial Times shows that a week later, UK bond yields are higher across the long-term yield curve.

Source: The Financial Times

Yields are also slightly higher than a month ago which was right after Carney smacked the British pound down after inserting commentary into the last rate decision that bond yields had gone higher than warranted by existing economic conditions. With UK bonds (gilts) at their highest yields since October, 2011, the British pound (FXB) has understandably continued its rally from recent lows:

Source: FreeStockCharts.com

{snip} Plenty of upside remains if current conditions continue.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 15, 2013. Click here to read the entire piece.)

Full disclosure: net long British pound