(This is an excerpt from an article I originally published on Seeking Alpha on July 27, 2013. Click here to read the entire piece.)

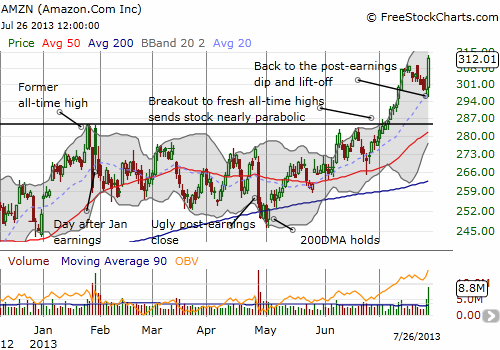

Amazon.com’s (AMZN) last three earnings cycles were quite challenging for the AMZN post-earnings trade. As a reminder, the AMZN post-earnings strategy is simply to buy the post-earnings open and hold for up to two calendar weeks. The trade ends if during the 2-week period, AMZN closes below the low of the day after earnings. There is an additional option to go short after that (no pre-defined exit criteria).

{snip}

The brief post-earnings hesitation was understandable given AMZN delivered mixed results yet again.

AMZN turned out another quarter of amazing sales growth:

{snip}

Yet, once again, it was profitless growth:

{snip}

These results prompted headlines bemoaning the losses. For example, Marketwatch pondered whether investors would finally start bailing on AMZN given its extraordinarily high valuation: “Amazon investors may start to get fed up. Commentary: Why is this stock trading at such a high multiple?.” It was a short summary that hinged on one analyst quote:

{snip}

Apparently, the clock is not close to finished. {snip}

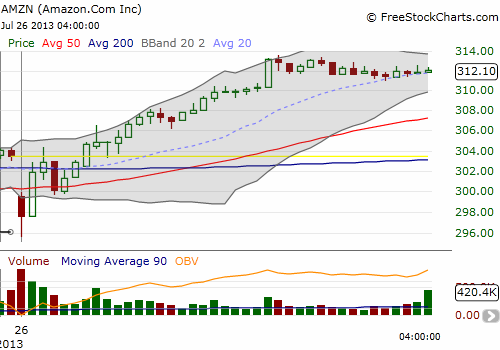

Source of charts: FreeStockCharts.com

The lesson I thought I had learned from the last two earnings cycles was to be patient at the open and go for a lower price on call options. This method worked well this round as the stock dropped quickly at the open and implied volatility began its expected implosion. {snip}

This one-day post-earnings run is more like the typical behavior I have come to expect from AMZN. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 27, 2013. Click here to read the entire piece.)

Full disclosure: no positions