(This is an excerpt from an article I originally published on Seeking Alpha on July 3, 2013. Click here to read the entire piece.)

In the past week, we have seen two different views on the Australian dollar (FXA) from official government sources.

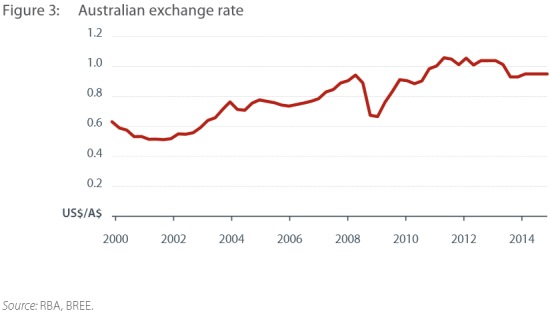

Last week, the Australian Government Bureau of Resources and Energy Economics (BREE) delivered its Resources and Energy Quarterly for June Quarter 2013. This report includes a 12-month projection for the exchange rate of the Australian dollar versus the U.S. dollar.

In the report, the BREE notes that the market is expecting further declines in the Australian dollar. {snip} I think a much lower level is supported by the BREE’s consideration of a scenario with an Australian dollar lower than the 0.92 level quoted as of June 24th:

{snip}

Last year, the BREE was really focused on the risk factors from Europe as an explanation for the decline in the Australian dollar at that time. I placed the emphasis in the quote below because it represents a rare direct and official acknowledgement that rate cuts CAUSE declines in the exchange rate:

{snip}

Fast forward to today and the story of a weakening Australian dollar has moved past issues in Europe and even rate cuts from the Reserve Bank of Australia:

{snip}

I think it is relatively safe to assume that the RBA is pretty close to the end of its rate-cutting cycle. {snip}

In this statement, the RBA was finally more direct in seeking a lower exchange rate:

{snip}

In other words, the RBA is not satisfied with the steep drop over the past three months. {snip}

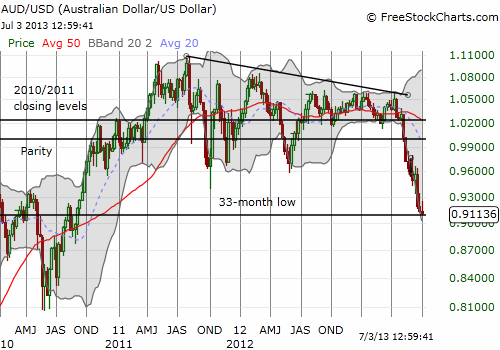

Putting this all together, I have decided to get more aggressive in bearish trades against the Australian dollar with a focus on fading rallies…{snip}

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 3, 2013. Click here to read the entire piece.)

Full disclosure: net neutral the Australian dollar