(This is an excerpt from an article I originally published on Seeking Alpha on April 29, 2013. Click here to read the entire piece.)

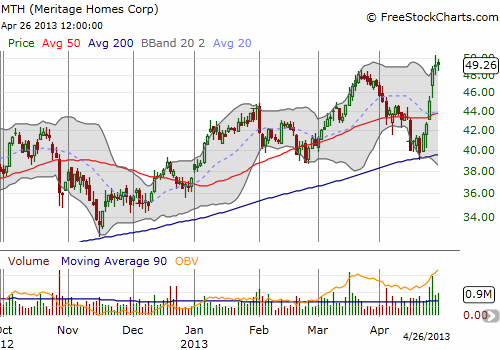

Meritage Homes Corp (MTH) is up 38% since I made it my #1 homebuilder stock for 2013. The stock is up 32% year-to-date. Too bad part of my investment strategy for homebuilders in 2013 included only buying on a significant dip. Almost five months later, I have yet to rebuild my exposure to homebuilders. Based on the latest earnings results from MTH, it seems I will not get a chance at another attractive discount for quite some time.

Source: FreeStockCharts.com

The company’s results on almost every score were absolutely outstanding. The introductory comments from CEO Steve Hilton summarize them well:

{snip}

MTH noted that this is the second year in a row that the Spring selling season has started strongly. MTH has now recorded its eighth straight quarter of year-over-year order growth.

{snip}

Not surprisingly, MTH’s guidance for the rest of the year is quite strong:

{snip}

MTH now trades at fresh 6 1/2 year high with a price-to-sales ratio of 1.5, price-to-book at 2.5, trailing P/E of 16.4, and an implied P/E for 2013 of 20.1 to 22.4. The stock seems fairly-priced at these levels, but I believe the stock could continue to rally on continued growth in the economy. {snip}

I have posted below a few additional notes from the earnings conference call using the Seeking Alpha transcript below. This is not a complete summary, and I have reordered commentary into three themes: financial performance, prices and margins, and the housing market.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 29, 2013. Click here to read the entire piece.)

Full disclosure: no positions

Hope you are well.

Does your republishing this today July 10th in an email mean you think it is time to buy it. Yes it’s a great company but after the Bernanke’s spiel, MTH, ITB and most if not all the builders can’t get off the bottom. And then there is the Bernanke again tomorrow.

Not quite yet. I have a pending piece on Seeking Alpha that touches on my approach. I have focused first on accumulating TPH given the high concentration in California. Staying patient to determine when is a good time to accumulate other builders. Many of them have put in topping patterns after almost a year of churn, so there is no rush. A larger sell-off gets me a lot more interested. Stay tuned.