(This is an excerpt from an article I originally published on Seeking Alpha on April 28, 2013. Click here to read the entire piece.)

The San Francisco Bay Area is known for its micro-climates. {snip} This area also has matching housing micro-climates. The crash and recovery from the housing bubble has exacerbated these micro-climates.

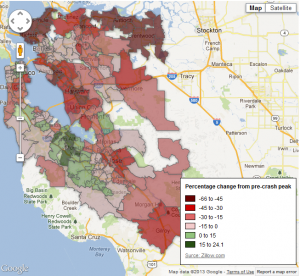

In “Bay Area housing recovery spreads from Silicon Valley to East Bay” Argus reporter Pete Carey describes these housing micro-climates with fascinating data and dramatic anecdotes starting with the following stark graphic:

Click for a detailed image…

Source: Bay Area housing recovery spreads from Silicon Valley to East Bay

The green areas are localities where housing prices are at or above their pre-crash peaks. In the most favorable areas with good school districts and plentiful jobs, the housing market is back to the good old bad days. Limited inventories, low interest rates, pent-up demand, and buyers flush with cash are scrambling to outbid each other and driving prices ever higher. {snip}

Further to the east is Stockton, now the country’s largest bankrupt city, gateway and ground zero for the state’s housing bubble and crash that rippled hardest throughout the central valley where houses multiplied much faster than jobs. {snip}

{snip}

So why spend time studying and tracking this madness?

First and foremost, this drama provides the backdrop for the great results homebuilders are reporting in their California-based communities. {snip}

Secondly and relatedly, the frenzy going on in the housing market is likely a leading (or confirming) indicator of an improving economy, albeit an unevenly recovering one (after all, California has a poverty rate of 16% using traditional measures. When using the Census Bureau’s new supplemental approach that adjusts for the cost of living, California’s poverty rate goes to tops in the nation at 23%). {snip}

Finally, the California housing micro-climates are a great reminder of why both housing bulls and bears can make convincing arguments. {snip}

Overall, the housing market recovery is still just getting started. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 28, 2013. Click here to read the entire piece.)

Full disclosure: no positions