(This is an excerpt from an article I originally published on Seeking Alpha on April 22, 2013. Click here to read the entire piece.)

It is that time of year: the next earnings report from Apple (AAPL). {snip} As Aaron Task says in the intro of today’s Daily Ticker – “Bracing for Disaster: How Bad Will Apple’s Earnings Be“? – the Apple earnings report is an event that is usually heralded with a lot of hype and anticipation. This time, it is being met with fear and dread.

{snip}

However, the concept of Apple bearishness is quite squishy. {snip}

Source: FreeStockCharts.com

This selling has barely attracted the interest of short-sellers. {snip} While shorts have been net buyers of Apple stock since then (covering positions), options players have loaded up on call options. {snip}

Analysts have been hitting the reset button, but almost none have recommended lightening up or outright selling shares. {snip}

So what is a nervous AAPL holder or trader to do? At this point, with a forward P/E of 8.1, AAPL does seem too cheap to sell. If you have held this long, you might as well give AAPL at least one last shot during the earnings report to deliver some news that can set a foundation for a recovery.

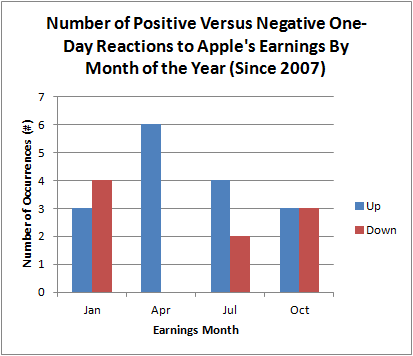

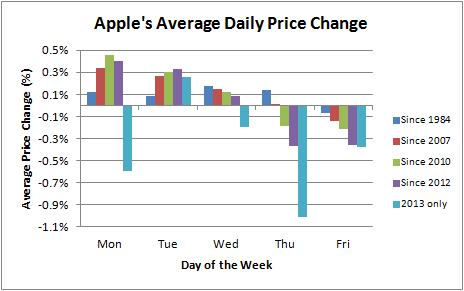

It probably also helps to look at Apple more as a trading vehicle than an investment until the news flow indeed improves. To that end, I am providing an update of BOTH the Apple pre-earnings trading model and the daily trading model in this post.

{snip}

{snip}

Click the image for a larger view…

{snip}

Click the image for a larger view…

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 22, 2013. Click here to read the entire piece.)

Full disclosure: long AAPL shares and call spread