(This is an excerpt from an article I originally published on Seeking Alpha on March 24, 2013. Click here to read the entire piece.)

{snip}

The reaction to the Cyprus news was swift in financial markets starting with currency markets on that Sunday. By the end of the week, the S&P 500 (SPY) remained down a small fraction of a percent, the volatility index (VIX) remained elevated from seven-year lows but well off its high of the week, the SPDR EURO STOXX 50 (FEZ) closed down 1.6%, the U.S. dollar index (UUP) gained 0.9%, and gold (GLD) managed to eke out a 1% gain. Needless to say, none of these reactions reveal panic or even much concern over the eventual resolution of the Cyprus crisis.

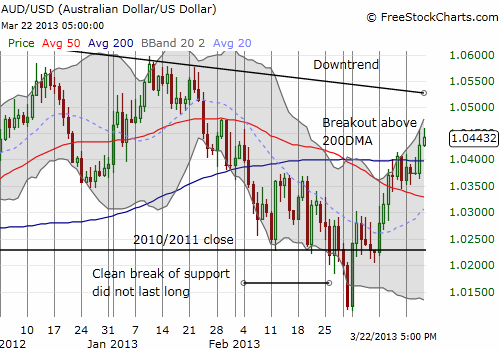

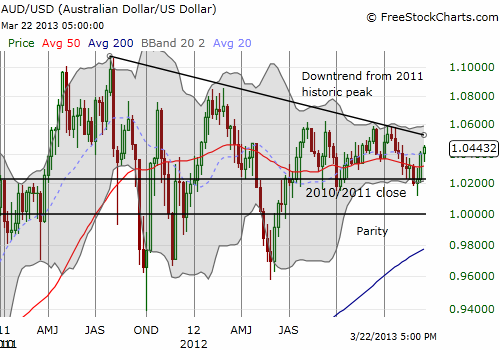

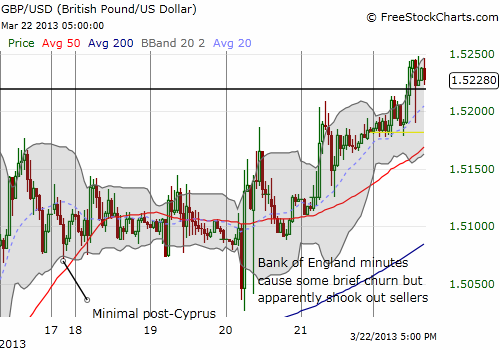

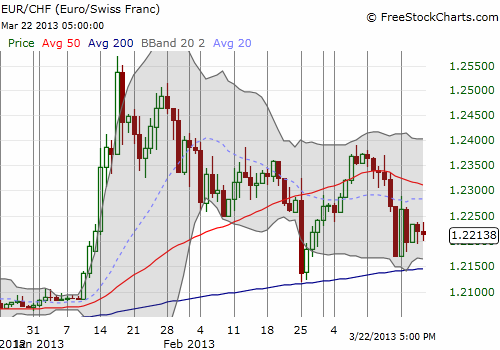

Most intriguing to me in currencies was the strength showed by the British pound (FXB) and the Australian dollar (FXA) and the lack of strength in the Swiss franc (FXF).

{snip}

{snip}

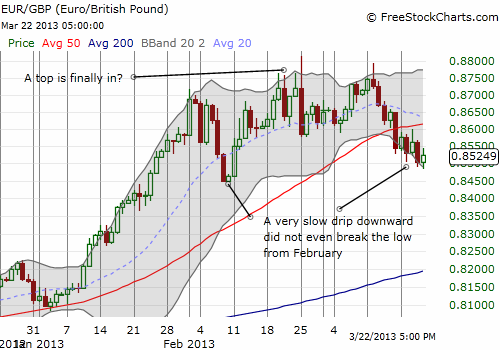

My large trade against the euro using the British pound was my best choice for the week, but I took profits after the EUR/GBP failed to follow-through on its breakdown. Holding onto the trade took a lot of patience. Thus, I will likely not re-enter until fresh weakness appears in the form of a new breakdown. For now, I continue to assume EUR/GBP has topped out for the foreseeable future.

This hourly chart shows that the British pound barely budged in Cyprus’s wake. After a lot of volatility, GBP/USD managed to close stronger on the week.

{snip}

{snip}

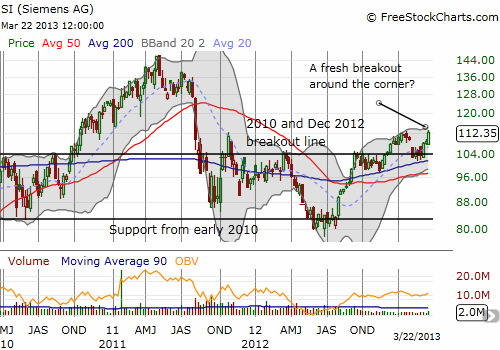

One of the bigger enigmas of the post-Cyprus week was Siemens AG (SI), the German industrial conglomerate. I like to think of SI as the final referendum on the health of the eurozone economy (although SI is a global company). {snip}

Source for charts: FreeStockCharts.com

Perhaps SI benefited from two analyst upgrades: to buy from Bank of America on the 18th and to overweight from Morgan Stanley on the 20th. Regardless of the reason, a continued rally from here would represent exceptionally bullish price action….and could confirm that the market is already forgetting about Cyprus’s troubles…

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 24, 2013. Click here to read the entire piece.)

Full disclosure: net short Australian dollar, net short British pound