This is an excerpt from an article I originally published on Seeking Alpha on February 21, 2013. Click here to read the entire piece.)

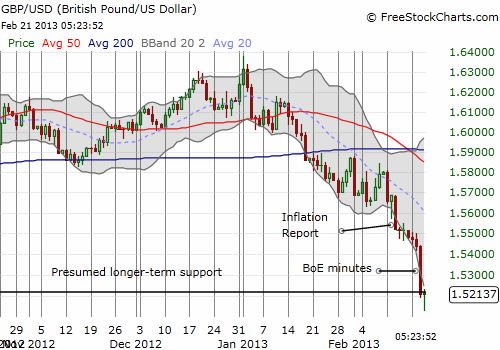

The Bank of England (BoE) released its latest Inflation Report last week (February 13, 2013). During his remarks and responses to questions, Mervyn King again explained how the current and expected weakness in the economy of the United Kingdom comes from the economic malaise in the eurozone, the UK’s largest trading partner. {snip}

King provided a one-two punch when he described the limits of monetary policy by essentially saying that monetary stimulus does not create incremental or new growth, it pulls forward the growth that would already have occurred in the future:

{snip}

Needless to say, the British pound (FXB) fell swiftly in the wake of the Inflation Report. {snip}

{snip}

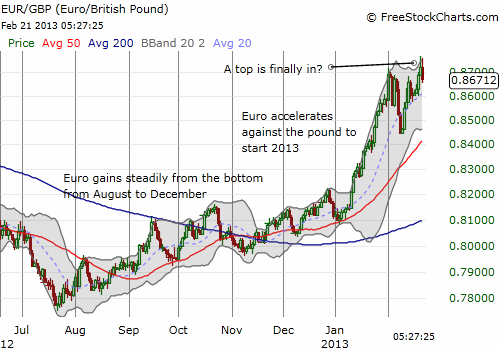

Now that the British pound is in full retreat, my eyes gaze next upon the euro (FXE). The euro has benefited mightily from a change in sentiment and a faith in Draghi’s word. If the pound tumbles on expectations for protracted economic malaise, I have to believe the euro will follow. {snip}

The euro has had a very strong run against the pound, but it now looks VERY vulnerable to a notable pullback. {snip}

The moves in the pound and the euro seem to be part of a sudden shift in the currency market to reverse the trends and assumptions that traders have come to comfortably rely upon for the past several months. {snip}

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on February 21, 2013. Click here to read the entire piece.)

Full disclosure: short EUR/GBP, EUR/USD