(This is an excerpt from an article I originally published on Seeking Alpha on January 13, 2013. Click here to read the entire piece.)

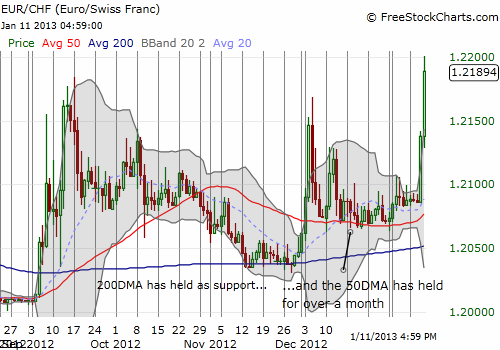

The Swiss franc (FXF) has had a floor against the euro (FXE) set at 1.20 for about 15 months. During that time, there was a stretch of about five months where EUR/CHF traded right on top of that floor. Traders never made a strong attempt to test the resolve of the Swiss National Bank (SNB). Based on trading over the past four months, I think that test will not come anytime soon. Indeed, it looks like it is time to get more aggressively bullish on EUR/CHF.

{snip}

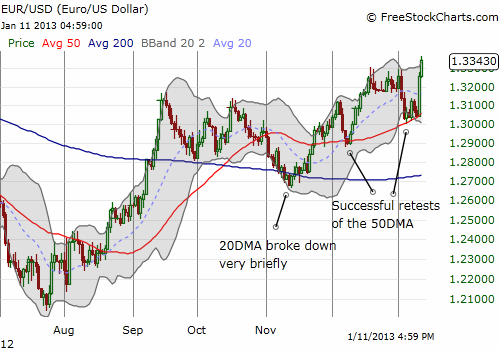

The U.S. dollar (UUP) is a great example of a currency which should be weaker but carries plenty of upside risk. The U.S. dollar (UUP) has proven incredibly resilient after QE3 and additional accommodation by the U.S. Federal Reserve by tying asset purchases directly to employment levels. This suggests to me that there is an upward bias waiting for a catalyst. For example, given the yen’s rapid decline and fall from favor, the U.S. dollar could easily become the overwhelming choice for “safety” whenever the next market scare occurs.

{snip}

{snip}

Source for charts: FreeStockCharts.com

EUR/CHF is now even more over-stretched than it was in early December or mid-September, so I expect some kind of pullback any day now. I want to buy that dip: the “fat franc” is singing the euro’s praises.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 13, 2013. Click here to read the entire piece.)

Full disclosure: no positions