(This is an excerpt from an article I originally published on Seeking Alpha on December 5, 2012. Click here to read the entire piece.)

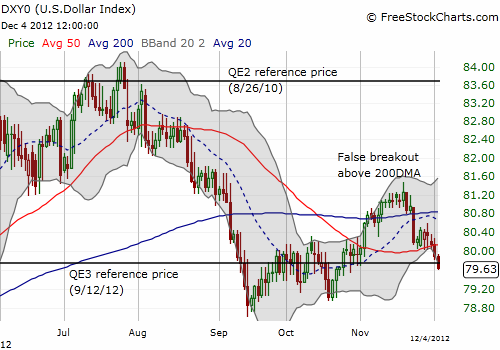

Almost three months have passed since the Federal Reserve announced a third round of quantitative easing. In that time, a Presidential election and now audible negotiations over the Fiscal Cliff have pushed QE3 to the backburner of media headlines. The lack of impact shows immediately in the path of the U.S. dollar index (UUP). {snip}

Source: FreeStockCharts.com

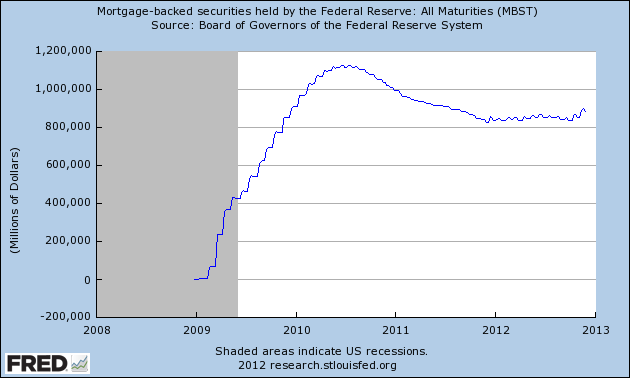

This churn undermines most attempts to explain the dollar’s weakness at one time and its strength at another time, but what is certain is that the Federal Reserve is just getting started on rebuilding its portfolio of mortgage-backed securities (MBSs) through QE3. {snip}

Source of graph: St. Louis Federal Reserve (FRED)

Given the relative trickle of purchases, it is not clear that the dollar will weaken as a direct result of MBS purchases in QE3. For now, I prefer to look at the euro (FXE), a little over 50% of the value of the dollar index, as a stronger driver.

{snip}

Source: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 5, 2012. Click here to read the entire piece.)

Full disclosure: no positions