(This is an excerpt from an article I originally published on Seeking Alpha on December 2, 2012. Click here to read the entire piece.)

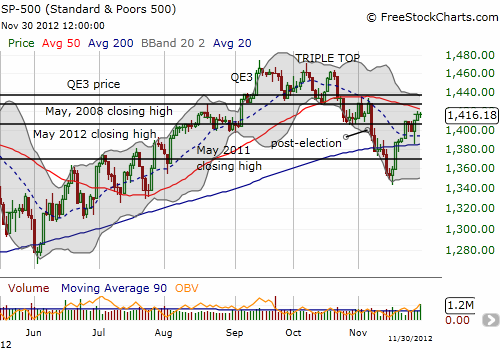

The rally from oversold conditions in the S&P 500 (SPY) from the November lows has now nearly recovered post-election losses. On the way up, we got to see whether Black Friday would trigger another bullish signal. After a close call, the S&P 500 managed to cling to its Black Friday gains over the subsequent six calendar days. This milestone triggers a very bullish outlook: since 1950 only 4 out of 13 years accomplished a similar milestone only to lose all of Black Friday’s gains in the next two weeks (for more details, see “Quantifying The Significance Of Black Friday Trading“).

{snip}

The obvious wildcard in this bullish outlook is the wrangling over the Fiscal Cliff. {snip} It seems to me a lot more of the potential of the U.S. economy will get unleashed on the other side of a positive resolution to the Fiscal Cliff. I saw this possibility in a recent interview with Honeywell (HON) CEO Dave Cote on Nightly Business Report.

In this interview, Cote said he fully expects a tax hike as part of a resolution on the Fiscal Cliff. However, these increases combined with entitlement reform should generate a much healthier economy in the balance:

{snip}

In the meantime, I sold the last of my positions in ProShares Ultra S&P 500 (SSO) and ProShares QQQ Trust (QQQ) just to lock in profits. I fully anticipate headline risks are going to create fresh buying opportunities in the coming days and weeks.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 2, 2012. Click here to read the entire piece.)

Full disclosure: no positions