(This is an excerpt from an article I originally published on Seeking Alpha on November, 2012. Click here to read the entire piece.)

The day after Thanksgiving, affectionately known as Black Friday, is an odd day of trading. For whatever reason, the exchanges open for business for part of the day even as most people still have vacation and/or shopping on the brain. Because of this partial trading and the accompanying light trading volume, the performance of stocks on Black Friday tends to get discounted as an anomaly. It turns out the data tell a much more nuanced story; traders should NOT discount Black Friday trading.

{snip} The Black Friday performance for 2012 ranks as the sixth best since 1950. {snip}

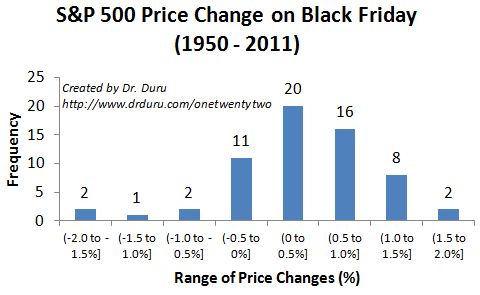

Source: Stock prices from Y!Finance, Black Friday calculated as the day after Thanksgiving which is assumed to be the fourth Thursday of every November

{Note that (x to y%] represents a range where x% is the lower bound but not included in the range, and y% is the upper bound and IS included in the range}

{snip} With only 16 down days compared to 46 up days, betting on a Black Friday rally is a pretty good bet. HOWEVER, 3 of the 16 down days occurred from 2009 to 2011. This year, broke the longest Black Friday losing streak since at least 1950.

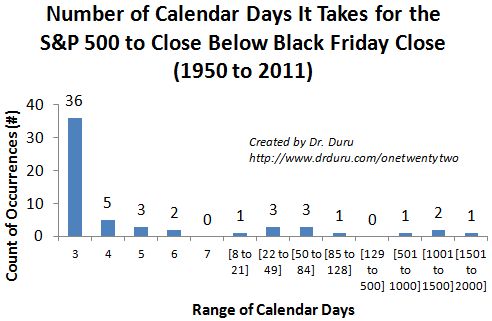

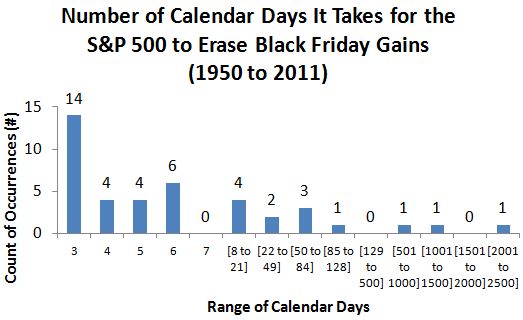

This tendency towards upside should be reason enough to pay attention to Black Friday. Yet, there are two more relationships to look forward to in the following week. {snip}

{snip} Special recognition goes to 1951, 1988, 1991, and 2011 (yes, LAST YEAR). The S&P 500 never looked back during these years, never closing below the Black Friday close. {snip}

{snip} Five years delivered Black Friday gains which have survived the test of time: 1953, 1958, 1962, 1982, and 1995.

{snip}

For those interested in some more formal statistics….

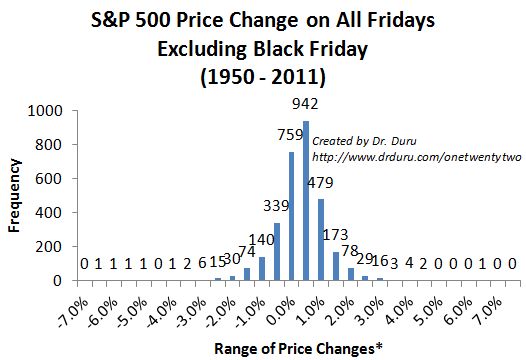

Black Friday’s one-day performance is statistically distinct from the performance of all other Friday’s since 1950. {snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November, 2012. Click here to read the entire piece.)

Full disclosure: long SSO shares