(This is an excerpt from an article I originally published on Seeking Alpha on November 17, 2012. Click here to read the entire piece.)

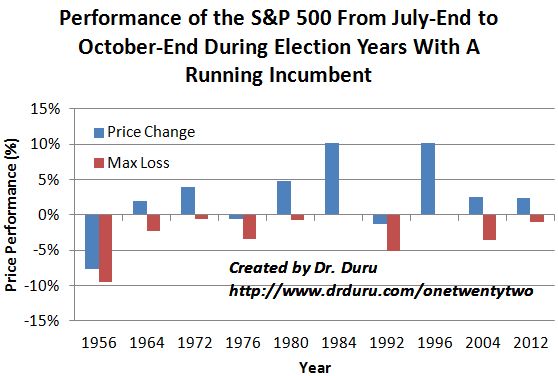

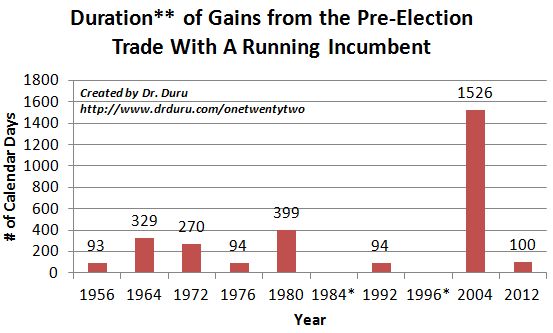

In early, July I quantified the very unique tendency of the S&P 500 (SPY) to deliver strongly positive returns in the three months (between July-end and October-end) before a Presidential election featuring an incumbent (see “The Positive Trade When Incumbent Presidents Run For Re-Election“). The analysis was motivated by S&P Capital IQ’s Sam Stovall who interpreted this effect in the opposite way: positive returns during this time period are predictive of an incumbent victory. It turns out Presidential incumbents tend to win re-election in the U.S., so I disagreed with Stovall’s interpretation. I next emphasized the attractiveness of this pre-election trade by noting that the maximum drawdown over this period is quite mild compared to the average 3-month period between July-end and October-end. The pre-election trade featuring an incumbent worked again this year, but these gains were short-lived. It turns out that the gains from the pre-election trade rarely last; the sugar-high is not sticky.

{snip}

{snip}

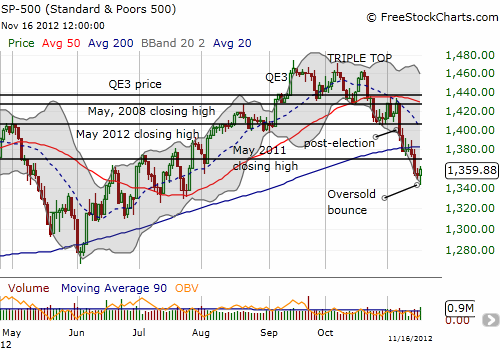

Source: FreeStockCharts.com

By the second day after the election, all the gains from the pre-election trade disappeared…{snip}… Of the ten re-election campaigns since World War II, this year’s is the only one to deliver positive gains during the pre-election period only to go negative right after the election. {snip}

A wide gulf exists between the bottom performers and the rest of the pre-election periods. {snip}

Source for price performance charts: Prices from Yahoo!Finance; election info from Wikipedia

{snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 17, 2012. Click here to read the entire piece.)

Full disclosure: long SSO shares and call options