(This is an excerpt from an article I originally published on Seeking Alpha on October 22, 2012. Click here to read the entire piece.)

{snip}

Google (GOOG)

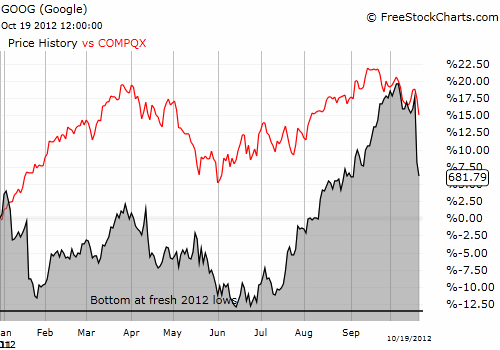

GOOG was a stock that had a lot of momentum off the summer lows although it still trailed the NASDAQ (QQQ) year-to-date. Ironically, GOOG finally caught up to the NASDAQ just as it peaked at its last all-time high on October 4th.

GOOG hit all-time highs for the first time since 2007 on September 24th. Over the next two days, open interest in the October $800 calls surged. As I pointed out before GOOG reported earnings, this indicated either traders trying to chase GOOG on momentum (the “buy high, sell higher” crowd) and/or a rush of major GOOG holders to sell premium while the getting was good. Either way, it presented the intriguing possibility of a pivot around $800 for earnings. {snip}

The rest is history as GOOG plunged as low as $676 when earning were released early before the close. {snip}

As much as I try to rely on data for formulating earnings trades, I learned that it is still easy to act on assumptions ahead of the evidence. I also learned once again the importance of context. {snip}

{snip}

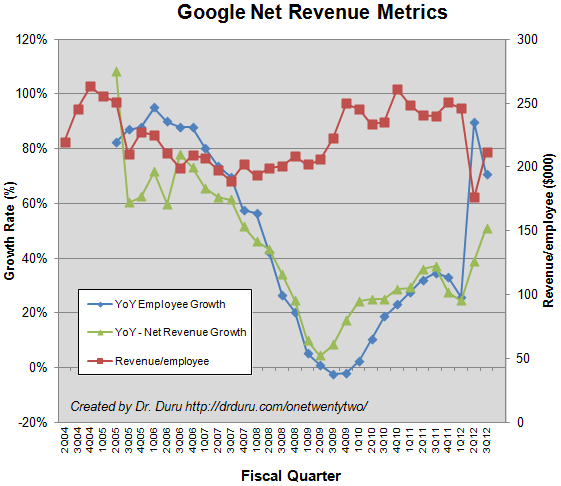

Source: Google earnings reports

Chipotle Mexican Grill (CMG)

With CMG, I applied my typical earnings trade template (see “Chipotle Bears Ready For Another Poor Earnings Performance But Watch Pre-Earnings Close“). The data were not as conclusive as I like for initiating a trade. {snip} At least my more conservative strategy for following the post-earnings momentum worked out fine with CMG opening down about 12%.

The lesson from CMG was quite clear: do not make a trade when the data do not ring loud and clear. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 22, 2012. Click here to read the entire piece.)

Full disclosure: no positions