(This is an excerpt from an article I originally published on Seeking Alpha on October 28, 2012. Click here to read the entire piece.)

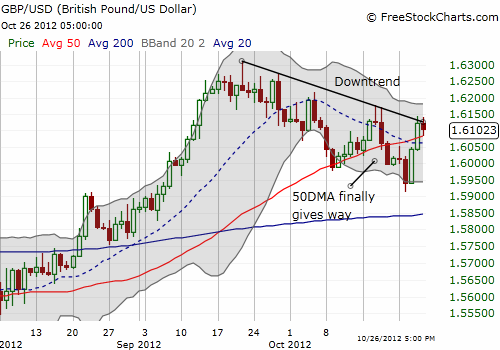

The British pound (FXB) was falling fast going into last week’s GDP number. The pound even broke through support at its 50-day moving average (DMA). It seemed like momentum was setting up for a major disappointment until the the GDP printed with 1.0% quarter-over-quarter growth, stronger than the 0.6% growth expected. GDP came in flat year-over-year whereas consensus expected a contraction of -0.5%. This better-than-expected performance set the pound soaring last Thursday (October 25th) as a follow-through to a bounce from six-week lows.

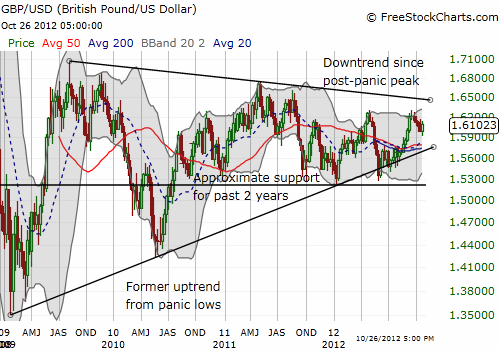

The pound’s strength has not yet sent it through the current short-term downtrend. {snip}

Source: FreeStockCharts.com

{snip}

What keeps me bearish on GBP/USD at these levels is that the growth patterns between the U.S. and the UK are still working out in favor of the U.S. The commentary from various economists reacting to the GDP number is very instructive for me.

It seems very possible that the third quarter was surprisingly strong simply because economists under-estimated the positive impact of the Olympics and/or over-estimated the negative impact of the Queen’s Diamond Jubilee. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 28, 2012. Click here to read the entire piece.)

Full disclosure: short GBP/USD