(This is an excerpt from an article I originally published on Seeking Alpha on October 25, 2012. Click here to read the entire piece.)

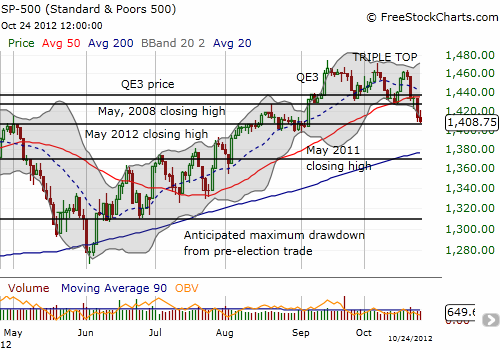

This week, the S&P 500 (SPY) has broken down, providing an early warning that QE3 is not working as expected. The S&P 500 is resting precariously at support formed by the May, 2012 high where the index also experienced one of its largest rallies of the year on September 6th.

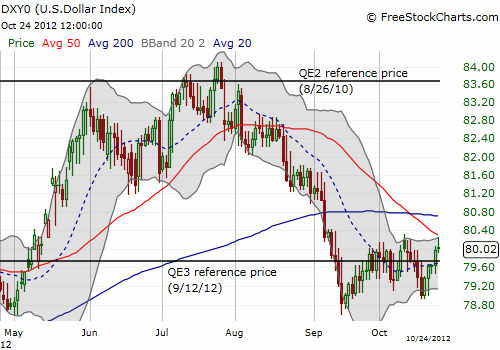

Even the U.S. dollar (UUP) has remained resilient and is near its highest point since QE3 was announced.

{snip}

Against this backdrop, I was surprised that the Federal Reserve did not issue a stronger statement on monetary policy on Wednesday in an attempt to jawbone the market higher. {snip}

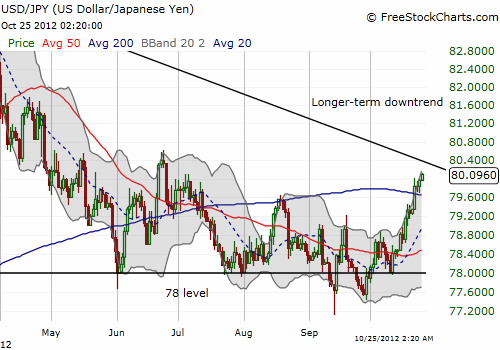

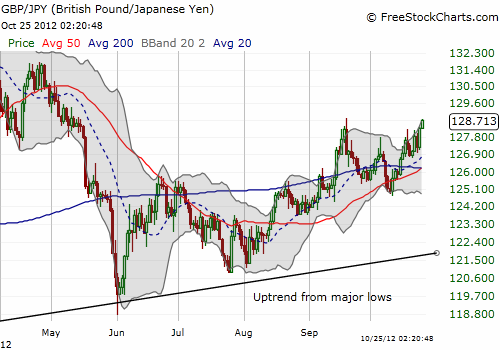

First, the Japanese yen (FXY) has not acted as the safety valve it typically does during such sell-offs. {snip}

{snip}

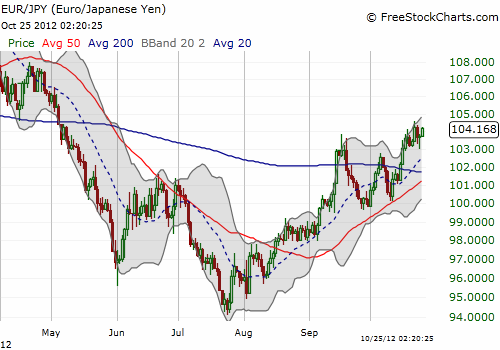

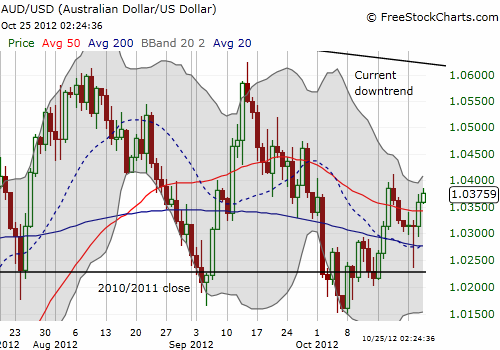

The yen’s correlation to the stock market has weakened and strengthened in phases, so the current divergence between USD/JPY and the S&P 500 should be treated as just one small signal requiring some confirmation. The Australian dollar (FXA) may be providing just such a confirmation.

Source for charts: FreeStockCharts.com

I have documented several times and in several ways the strong positive correlation between the Australian dollar and the S&P 500. On Wednesday, a rare event happened. The Australian dollar experienced a nice rally while the S&P 500 sank. {snip}

I consider the divergence between the Australian dollar and the S&P 500 to be a nascent bullish sign. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 25, 2012. Click here to read the entire piece.)

Full disclosure: long SSO calls, long EUR/JPY