(This is an excerpt from an article I originally published on Seeking Alpha on October 17, 2012. Click here to read the entire piece.)

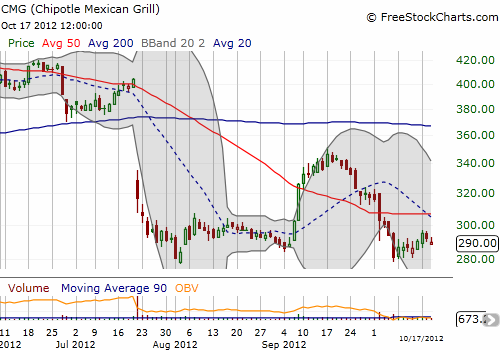

After Chipotle Mexican Grill (CMG) reported earnings in July, the stock fell 21.6%. This loss was CMG’s biggest in its almost seven years as a publicly traded company. The stock sold off another 12% before finding a bottom. This bottom has managed to hold despite a retest almost two weeks ago after David Einhorn revealed his short position in the stock.

Source: FreeStockCharts.com

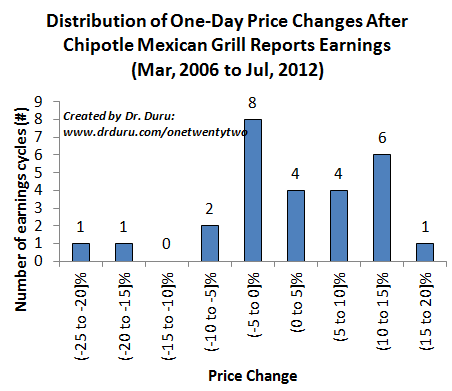

Source: stock prices from Yahoo! Finance, earnings dates from briefing.com

The distribution of one-day post-earnings moves shows that typically CMG delivers positive gains after earnings. Large changes are heavily skewed to the plus side.

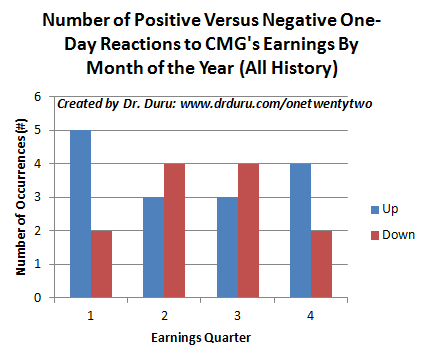

CMG steps up for judgement once again when it reports earnings after the market closes on Thursday, October 18th. {snip}

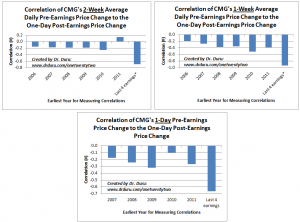

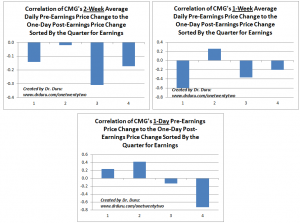

It turns out that strong correlations between pre-earnings trading and post-earnings trading have only appeared across the last four earnings cycles. {snip}

Click for a larger view…

The recent mild bounce in CMG ahead of earnings has produced a split in the 7 and 14-day averages for price change, implying that the price change for Thursday may cast the deciding ballot. Over the last 14 trading days, CMG has experienced an average price change of -0.61% while over the past 7 days the average daily price change has been 0.55%.

{snip}

{snip}

Click for a larger view…

{snip}

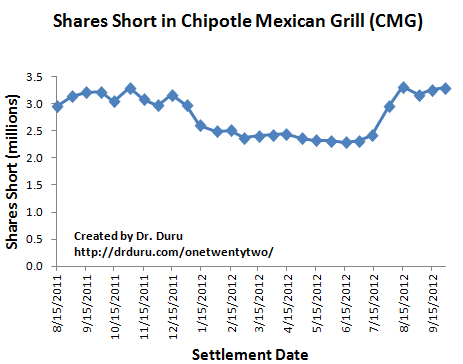

Finally, CMG shorts are quite clear in their expectations for a poor showing. {snip}

Source: NASDAQ.com short interest

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 17, 2012. Click here to read the entire piece.)

Full disclosure: no positions