(This is an excerpt from an article I originally published on Seeking Alpha on September 14, 2012. Click here to read the entire piece.)

Skullcandy (SKUL), a developer and distributor of audio accessories, is back in focus. Morgan Stanley (MS) slammed the company with a downgrade from overweight to equal weight and a cut in its price target from $21 to $15. On a day when the S&P 500 (SPY) rallied 1.6% to near 5-year highs, I was quite surprised to see a downgrade cause SKUL to drop 16% on extremely strong volume to an all-time low. The stock closed the day at $11.92, creating, according to Morgan Stanley, a 26% upside opportunity.

Source: FreeStockCharts.com

{snip}

According to Morgan Stanley’s earnings cut, SKUL now has a 10.6 P/E for 2012 and a forward P/E of 8.5 for 2013. These valuations seem quite reasonable and further underline the buying opportunity for SKUL. {snip}

Eric Savitz provided Morgan Stanley’s rationale in “Skullcandy Shrs Gets Kick In The Head From Morgan Stanley.” Essentially, Morgan Stanley is concerned about growing competition that seems to be driving prices down for SKUL products. Morgan Stanley is also worried that SKUL does not compete well at the high end.

{snip}

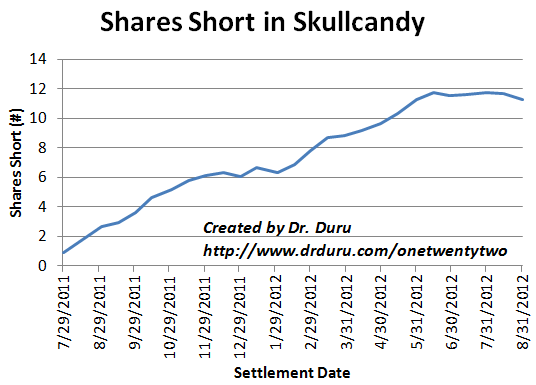

Source: NASDAQ short interest

{snip} With a price target 26% higher from current levels, SKUL will very likely outperform any diversified benchmark from current levels.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 14, 2012. Click here to read the entire piece.)

Full disclosure: no positions