(This is an excerpt from an article I originally published on Seeking Alpha on August 17, 2012. Click here to read the entire piece.)

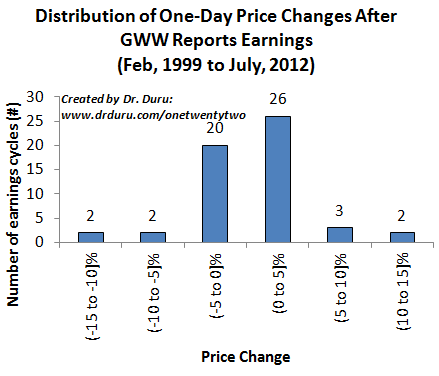

Almost two months ago, I wrote about Fastenal (FAST), an industrial and construction supplier, describing the stock as expensive but worth buying at lower prices. Within a month, FAST jumped over 10% before its rally ended at resistance. In the same article, I compared FAST to W.W. Grainger (GWW), a parts distributor, and pointed out how GWW was falling in sympathy. Since then, I have kept an eye on both stocks. I took particular interest after GWW soared an uncharacteristic 11% after reporting earnings on the morning of July 18th.

I had to reach all the way back to February 3, 1999 to find a larger, one-day, post-earnings response (14%). The last double-digit response in either direction was a 14% drop on July 17, 2006.

Sources: Earnings dates from briefing.com, price data from Yahoo!Finance

{snip}

Gains from these levels are likely not going to be easy. With a 12-month trailing P/E of 21, GWW is already well above its annual average over the past 9-10 years. The story is the same for price-to-sales and price-to-book.

Here are some key notes I took from the earnings call using Seeking Alpha transcripts. (The company did not host a Q&A session).

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 17, 2012. Click here to read the entire piece.)

Full disclosure: no positions