(This is an excerpt from an article I originally published on Seeking Alpha on August 11, 2012. Click here to read the entire piece.)

Wednesday, August 8th was a rough day for priceline.com (PCLN). The company significantly pulled back current quarter revenue and earnings guidance based on expectations for poor performance in Europe:

{snip}

Moreover, PCLN took this opportunity to remind investors yet again that past growth rates are not likely to continue in the coming quarters:

{snip}

Despite the issues in Europe and the imminent tougher comps, PCLN spent almost three months of this year hitting all-time highs. The problem with the stock started with the May earnings. Ahead of that I wrote “Arrows Pointing South For Priceline.com Post-Earnings” combining historical price and fundamental data to estimate the likelihood of up or down post-earnings performance. {snip}

Since 2007, PCLN has only sold off in 6 of 22 earnings announcements, including the last one. {snip}

{snip}

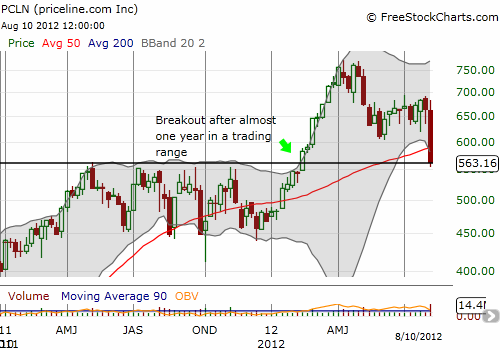

PCLN’s 17% drop in response to the poor earnings report gapped the stock down below its 200-day moving average (DMA). Even more importantly, at the lows, PCLN traded down to critical support at $560.

{snip}

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 11, 2012. Click here to read the entire piece.)

Full disclosure: no positions