Apple (AAPL) filled last week’s post-earnings gap in just four days. As discussed in “Apple’s Important Macro And Forex Calls And Likely Post-Earnings Recovery,” AAPL’s historical performance suggested a near certainty that this gap would get filled BEFORE the next earnings report. I gave a 50/50 chance on whether the gap would get filled in just a few days or whether it would take most of the quarter. The 4.3% post-earnings drop placed AAPL’s performance on a perfect dividing line between short and long recovery scenarios. Now we know to expect a short recovery if AAPL has a similar drop in the future.

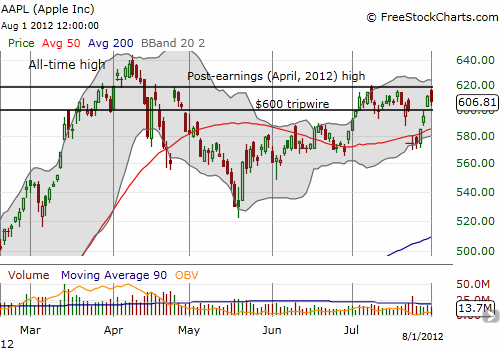

The bounce has returned AAPL into what is starting to look like an extended trading range, perhaps even consolidation. In the chart below, I sketch out a likely range between $600 and $620, where $620 served as the peak of the post-earnings price performance from April earnings.

Source: FreeStockCharts.com

A break above $620 would be extremely bullish for AAPL in the near-term. Only a break to new post-earnings lows would switch my trading signal to bearish, and I consider such an event very unlikely, absent any new, negative catalyst. In fact, the 50-day moving average (DMA) should serve as firm support. So, while the current trading patterns unfold, I remain biased toward buying the dips.

Be careful out there!

Full disclosure: long AAPL calls