(This is an excerpt from an article I originally published on Seeking Alpha on July 7, 2012. Click here to read the entire piece.)

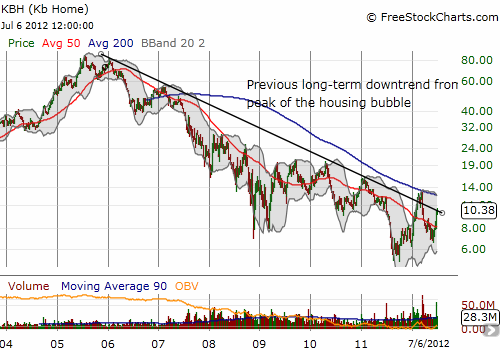

Kb Home (KBH) has finally recovered most of its losses following its March 23rd earnings report. On that day, the market took KBH down 8.5% in response to those earnings, but I still concluded that the outlook for KBH continued to improve. I recommended buying the stock between $7.50 to $8.00, assuming that the market negativity would take the stock down much lower. In three more weeks, KBH fell 27.1% to $7.50. At that point, I again recommended buying KBH, this time at $7.50 (see “KB Home Finally Approaches Buy Point Amidst Post-Earnings Selling Pressure“). As of the July 6th close, such a purchase would have delivered 38% upside with a maximum drawdown of 13% (in early June).

{snip}

{snip} During this last earnings conference call, management’s tone was decidedly bullish. {snip}

“With our operational momentum and the markets improving, we are going on offense, and I have personally made this my top priority. We are aggressively investing in land assets and communities, activating communities in stabilizing markets, increasing revenues per community and strengthening management teams with additional resources.”

{snip}

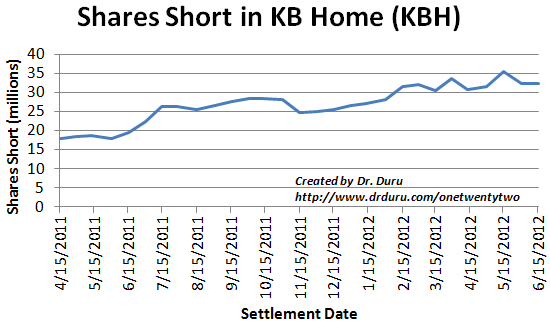

While I continue to get more and more encouraged by KBH’s results, shorts are clearly not impressed. {snip}

{snip} For some perspective…{snip}

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 7, 2012. Click here to read the entire piece.)

Full disclosure: long KBH