(This is an excerpt from an article I originally published on Seeking Alpha on July 1, 2012. Click here to read the entire piece.)

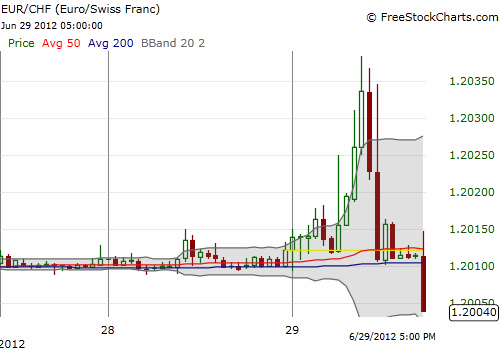

On Thursday, June 28th, Swiss National Bank (SNB) vice chairman Jean-Pierre Danthine repeated a claim made consistently by the SNB: at 1.20 the Swiss franc is overvalued relative to the euro. So, one would think that on a day when the euro (FXE) surges in response to surprise progress from the 19th European Summit, the EUR/CHF currency pair would finally get a lift. Quite the contrary. While EUR/CHF did nudge upward slightly to start the day on Friday, June 29th, the currency pair closed at its lowest point since the SNB established the 1.20 floor last September.

Source for charts: FreeStockCharts.com

I have stated before that euro-optimism must be tempered until the “fat franc flies.” I think that remains the case. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 1, 2012. Click here to read the entire piece.)

Full disclosure: long EUR/CHF