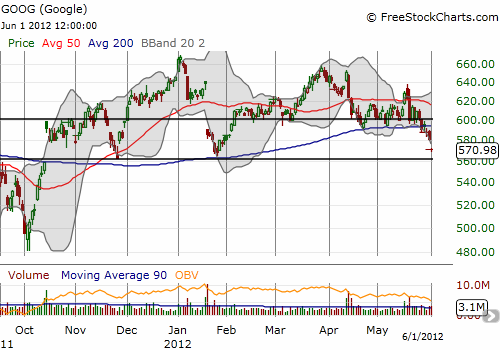

On May 20, I wrote “How To Play The End Of Google’s ‘Nine Lives’ Around $600” where I outlined the technical case for Google (GOOG) finally breaking through $600 support. It turned out to be quite timely. With the stock now trading below the 200-day moving average (DMA) for the first time since last October, the bearish case for GOOG’s technicals are confirmed. The next critical support awaits directly below at $560.

Source: FreeSockCharts.com

If GOOG manages to bounce from $560 support, I strongly suspect the 200DMA will serve as firm resistance. It should take a fresh catalyst to push GOOG back over $600. Either point makes sense as a place to place fresh bearish bets. If support at $560 breaks, Google could quickly drop back toward $500. Either way, I believe GOOG is very likely to make wide and swift moves from current levels. Under such conditions, it should be OK to buy weekly calls and puts outright rather than use the call spread strategy I discussed in the earlier piece.

If soaring implied volatility cranks up the expense level on these options, then I like call spreads with the short side pinned at $600 for bullish bets. For bearish bets on a break of $560 support, I like put spreads with the short side pinned at $500 or $510. For bearish bets on a fade from resistance, I like put spreads with the short side pinned at $560. (As a reminder, the idea is to reduce the expense of the options trade while maximizing the likelihood that the spread will reach close to full value before expiration).

Be careful out there!

Full disclosure: long GOOG put spread