(This is an excerpt from an article I originally published on Seeking Alpha on May 17, 2012. Click here to read the entire piece.)

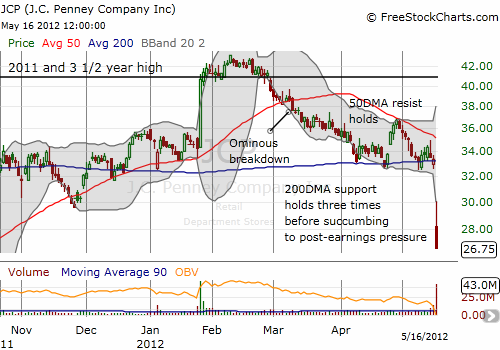

The past three earnings cycles have delivered some tremendous post-earnings successes in stocks like Amazon.com (AMZN), priceline.com (PCLN), Best Buy (BBY), and Apple (AAPL). J.C. Penney (JCP) broke my streak in dramatic fashion. In an earnings shocker, JCP disappointed just about everyone and received a one-day discount of 20% in return. This was JCP’s worst one-day performance ever. The chart below includes some important technical milestones for the stock.

Source: FreeStockCharts.com

{snip}… I did hold onto speculative call options into the earnings announcement. I interpreted a sharp drop in the put/call ratio as a bullish sign. {snip}

My bullish positioning was a 180 degree turn in strategy from my observations and conclusion in late March:

{snip}

I completely overwrote this analysis by selectively over-emphasizing the decline in the put/call ratio. I have recorded several lessons from this episode of allowing the put/call ratio to fool me:

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 17, 2012. Click here to read the entire piece.)

Full disclosure: long JCP calls