(This is an excerpt from an article I originally published on Seeking Alpha on May 18, 2012. Click here to read the entire piece.)

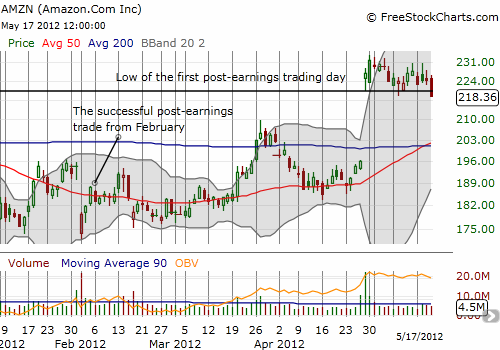

Amazon.com (AMZN) reported earnings April 26th and soared in the after-hours about 22%. At the time, I decided to call an “audible” on the AMZN post-earnings play and avoid the trade unless the stock dipped significantly. Much to my surprise, the bullish AMZN post-earnings trade still turned out a 1.3% gain after two weeks.

{snip}

Source: FreeStockCharts.com

The stop-loss rule improved gains on the post-earnings play by preventing the worst losses (see “Why Amazon.com Was A Buy At the Open After Reporting Earnings“). Since 2009, there have only been 5 cycles out of a total 14 where the stop-loss triggered, including the current one since the stock price has triggered only AFTER the two-week period. This fact means that the short signal must be tightly managed. {snip}

{snip} I am NOT pulling the trigger yet because the general stock market is oversold…{snip}.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 18, 2012. Click here to read the entire piece.)

Full disclosure: no positions