(This is an excerpt from an article I originally published on Seeking Alpha on April 8, 2012. Click here to read the entire piece.)

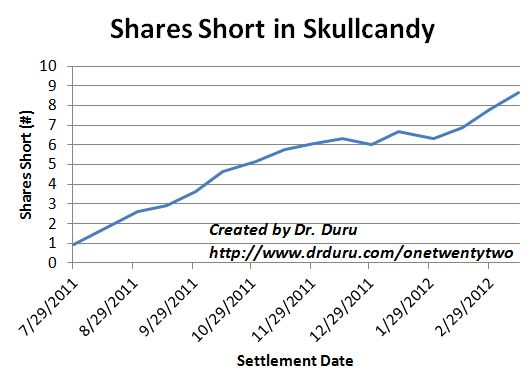

In early March, I took Skullcandy (SKUL) off my buy list of stocks with insider buying activity because the CFO, who was the main insider buying shares, resigned from the company (see “Removing Skull Candy From Buy List Of Insider Stock Purchases“). What I did not realize at the time is that short interest in SKUL had surged about 14% going into that announcement. Short interest surged about another 11% after the CFO’s resignation. Shorts have increased consistently throughout SKUL’s short life as a publicly traded company. Indeed, as of March 15th, shorts represent an incredible 124% of SKUL’s float.

Source: NASDAQ.com short interest for SKUL

{snip}…even as the stock market has fully recovered to new multi-year highs, SKUL has yet to regain its IPO price, much less achieve new highs.

Source: FreeStockCharts.com

{snip}

Regardless, shorts are currently paying a small price for being early. After the stock gapped down 8% on news of the CFO’s resignation, it fully recovered its losses in four days. The stock has GAINED an additional 15% since then. Suffice to say, I will be watching the company’s next earnings report with a lot more interest now. The huge short interest in this stock is setting up a potentially massive short squeeze.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 8, 2012. Click here to read the entire piece.)

Full disclosure: no positions