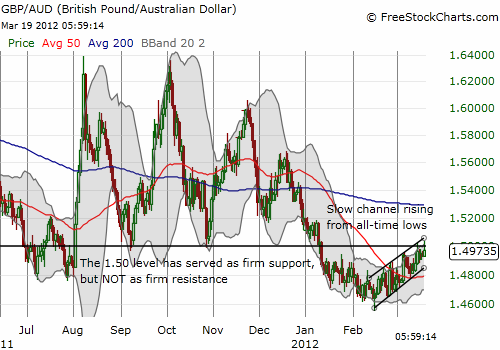

The GBP/AUD currency pair – the British pound versus the Australian dollar – combined the best of two worlds for me: my bearishness on the British pound and my bullishness on the Australian dollar. Even though I ended my love affair with the Australian dollar almost two weeks ago, I continue to enjoy trading the Aussie on a short-term horizon. However, the steady creep upward in GBP/AUD is potentially signaling the end of trading the Aussie against the pound for now.

Source: FreeStockCharts.com

The beauty of the channel shown above is that I can fade rallies and relatively reliably find a profitable exit point within a day or two (usually after building the position in small pieces). However, GBP/AUD has punched through the 1.50 “magic number” twice in the past week. This level has served as firm support for extensive rallies in the currency pair, but it has not delivered much resistance. A firm close above this level will likely terminate this channel trade for me. I am particularly cautious because GBP/AUD is coming off fresh historic lows in February. The last time this pair bounced from historic lows in July, 2011, it zoomed almost to 1.63 before the rally ended (a 9.7% move from top to bottom in less than one month).

I will next watch for GBP/AUD’s behavior at the 200DMA line of resistance. Note well that recent history suggests this line will also provide very little resistance. (It is very likely that the pound and Aussie trade much more strongly on the technicals versus other currencies).

In other words, time is running out on this bearish trade.

Be careful out there!

Full disclosure: no positions

1 thought on “Chart Review: Time Running Out For Trading the Australian Dollar Against the British Pound?”