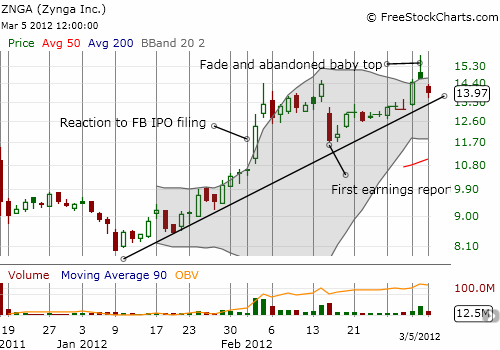

Zynga (ZNGA) has established itself as a resilient IPO so far. After an IPO on December 16, 2011 at $10/share, an open at $11, and a high of $11.50, ZNGA quickly sold off as low as $7.97 on January 9, 2012. From there, the stock rallied in almost a straight line, receiving a turbo boost from Facebook’s IPO filing which revealed that the company contributes 12% of Facebook’s revenues. Earnings disappointed to the tune of a 21.6% drop, but ZNGA powered to new all-time highs from there.

Source: FreeStockCharts.com

On Friday, ZNGA raced to a fresh all-time high of $15.91, presumably in sympathy with the IPO of Yelp (YELP). It quickly lost almost all its gains. In the chart above, you can see how today’s follow-through selling created what is known as a bearish abandoned baby top. This is basically a setup where all the buyers on Friday suddenly find themselves trapped by instant losses. The goodness is that ZNGA’s uptrend remains intact. If that uptrend breaks, I will look to the post-earning lows as firmer support.

Until Facebook’s IPO hits the market, ZNGA is going to remain the best way to play the hype. I plan to continue to buy its dips and sell its rips.

Be careful out there!

Full disclosure: no positions