(This is an excerpt from an article I originally published on Seeking Alpha on February 12, 2012. Click here to read the entire piece.)

Volatility has been on the rise over the past five days, and on Friday it really perked up to the tune of an 11.6% jump.

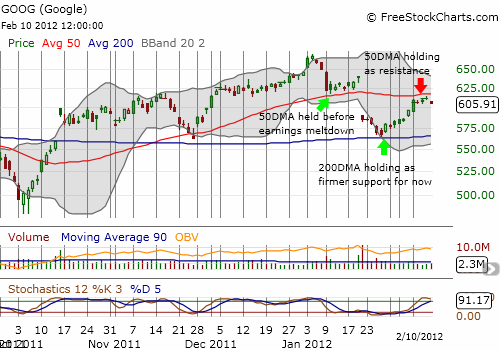

This spike in volatility off the bottom sent me scrambling for a fresh bearish play. I have tracked Google (GOOG) more closely ever since the hype in Facebook’s IPO sent almost all things internet reaching for the moon. GOOG did not experience a large surge until Monday, February 6. Volume has tapered off quickly since then, and the stock has been unable to penetrate overhead resistance at the 50-day moving average (DMA). (Technicians will also note in the chart below that GOOG’s stochastics have turned overbought as well – very ominous given the proximity to resistance).

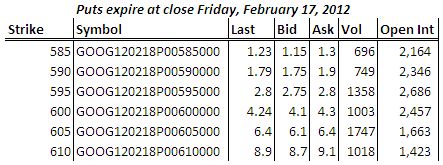

With one week to go until expiration, put options offer an attractive set-up for playing the potential for GOOG to sell-off next week.

Source: Yahoo!Finance

{snip}

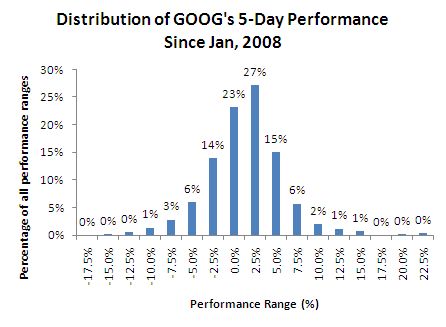

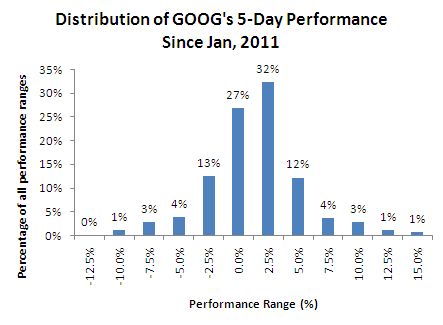

For reference purposes, I have posted distribution charts of GOOG’s 5-day performance over the last four years. {snip} The x-axis below represents the top of a performance range that starts with the next lowest number. For example, in the 4-year chart, the 23% on top of the bar at 0.0% on the x-axis means that 23% of the time, GOOG generated a 5-day performance of -2.5% to 0% (exclusive of 0%).

Since this entire speculation on a short-term drop in GOOG’s stock rests on the assumption that volatility is signaling much lower prices in the coming week, I decided to hedge my bet with puts (also expiring on Friday) on VXX…{snip}

Source for all charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 12, 2012. Click here to read the entire piece.)

Full disclosure: long put spreads in GOOG, long VXX puts, long VXX shares