(This is an excerpt from an article I originally published on Seeking Alpha on February 7, 2012. Click here to read the entire piece.)

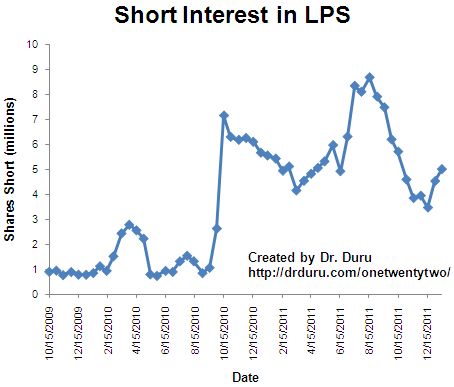

Lender Processing Services (LPS) has gained 31% year-to-date. This jump follows the activity of intrepid traders/investors who loaded up on LPS June $21 call options in December – these call options have now roughly doubled in price. Call buyers rushed in after LPS dropped 17% in one day after the company’s legal woes worsened. In parallel, LPS’s new troubles emboldened shorts to return after a steep 4-month drop in short interest. {snip}

Source: NASDAQ.com

Buying volume in LPS shares has significantly increased over the past two days as the stock sliced right through 10-month resistance at the 200-day moving average (DMA). {snip}

Source: FreeStockCharts.com

Adding to the intrigue was a surge in call buying in the February 19 strikes. A total of 8,313 call options traded hands versus 175 calls in open interest. Either shorts are rushing to hedge their positions or the catalyst that encouraged traders to load up on June $21 call options has been rescheduled to arrive four months early. Regardless, I consider it very bullish to see strong buying volume matched with outsized call trading/buying accompanied by a break of critical resistance levels. Note well that the 831,300 shares represented by these call options equal of 63% of the 3-month average trading volume in shares of LPS.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 7, 2012. Click here to read the entire piece.)

Full disclosure: long LPS shares and calls