I have written several pieces recently on the housing industry, starting with “Time to Buy the Dips in Homebuilders” (click here for an archive of my articles on housing). The main theme has emphasized that now is the time to start investing in a bottom in housing that I anticipate happening next year. I have advised readers to wait for a dip before buying given how far these stocks have run. Unfortunately, these stocks refuse to cooperate!

On Friday, KB Home (KBH) jumped an amazing 12.8% to a fresh 6-month high. Buying volume was very strong, confirming a very bullish extension off support at the 200-day moving average (DMA). I consider this strong move a definitive and perhaps decisive follow-through to the last high-volume surge on January 11, 2012 which took KBH into a retest of the 200DMA for the first time since last summer. I still cannot encourage interest investors to chase this stock here; especially given the over-extended and overbought conditions in the stock market. The best I can say now is that perhaps you will get a chance on a dip and retest of the 200DMA. The daily chart below shows the current set-up. The weekly chart below reminds us that KBH is still trapped in a long-term downtrend, representing both the downside risk and the tremendous upside opportunity.

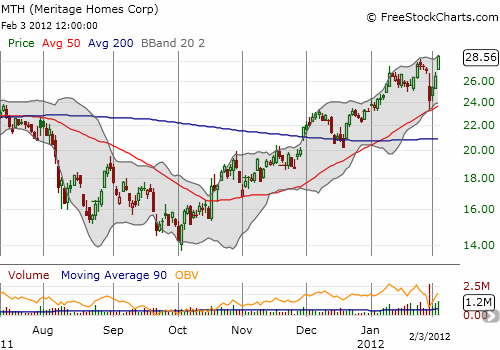

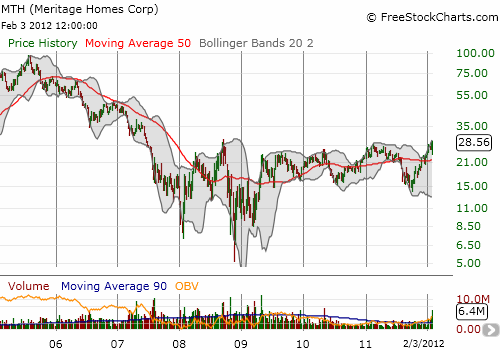

Meritage Homes (MTH) provides additional confirmation that the demand for homebuilder stocks is strong and perhaps increasing. MTH reported disappointing earnings last week and promptly dropped 11%. The stock retested its upward sloping 50DMA. MTH has also not looked back since as it recouped those losses in two days. On Friday, MTH set a fresh high dating back to September, 2008…right before the bottom fell out the market during the financial panic.

In other words, the charts are telling me that investors are already looking at the green grass on the other side of a housing bottom.

Source for all charts: FreeStockCharts.com

Be careful out there!

Full disclosure: long KBH

Are you sure that the information you posted here is exact? It’s quite obvious that you are on the side of MTH.