(This is an excerpt from an article I originally published on Seeking Alpha on February 1, 2012. Click here to read the entire piece.)

Trading through the earnings of a highly volatile stock often feels like flipping a coin. A trader must try to predict the earnings results AND the market’s reaction to those results. Some stocks are much better to trade after the results and the market’s initial reaction are known. Amazon.com (AMZN) is one of those stocks. Over the last twelve earnings reports, buying AMZN at the open has produced a winning trading strategy.

{snip}

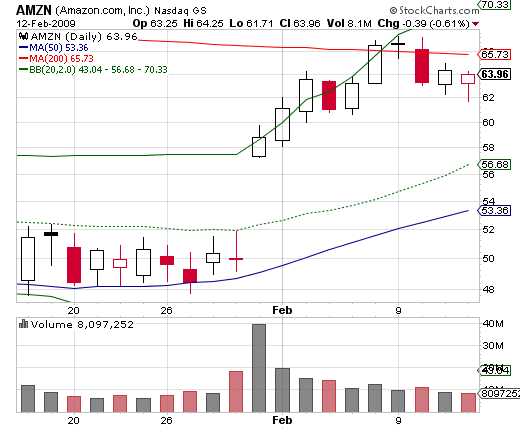

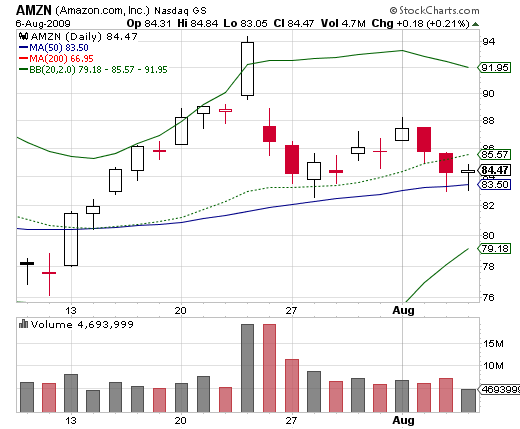

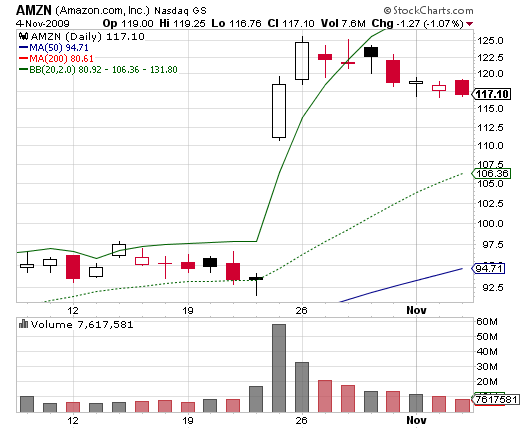

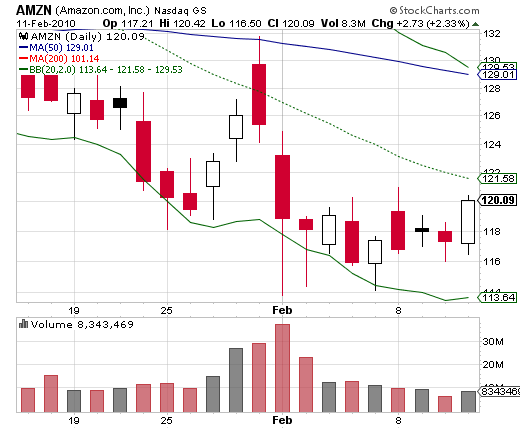

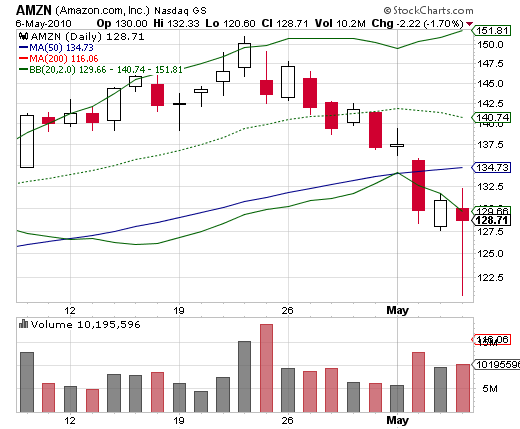

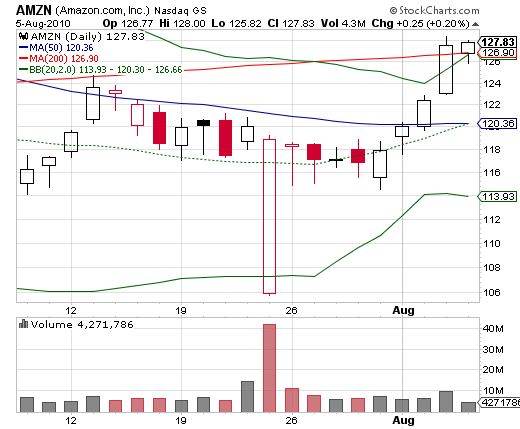

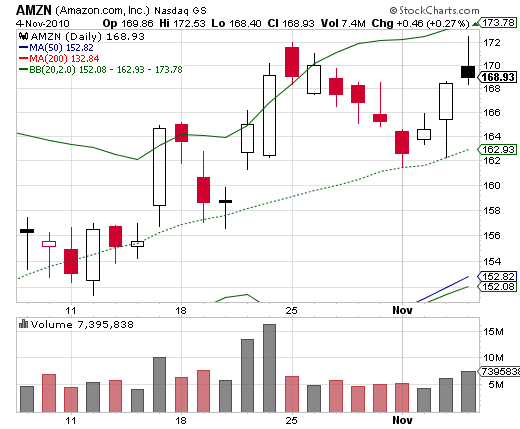

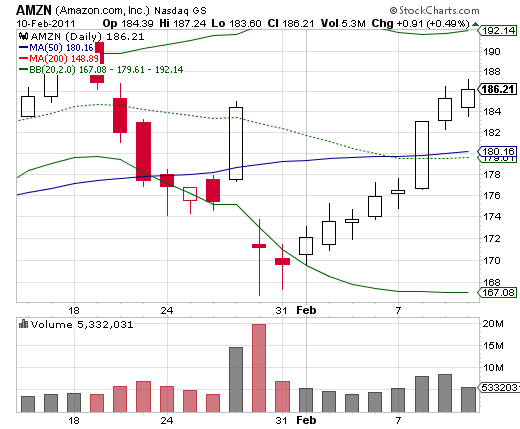

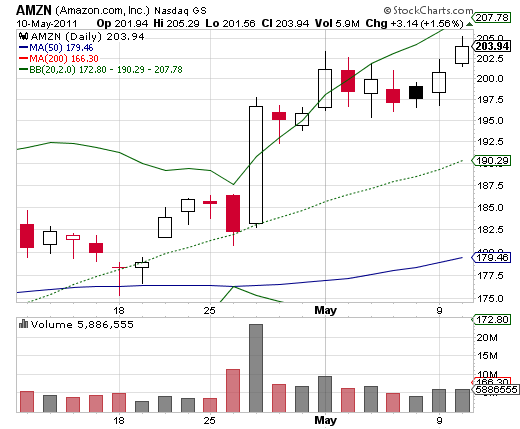

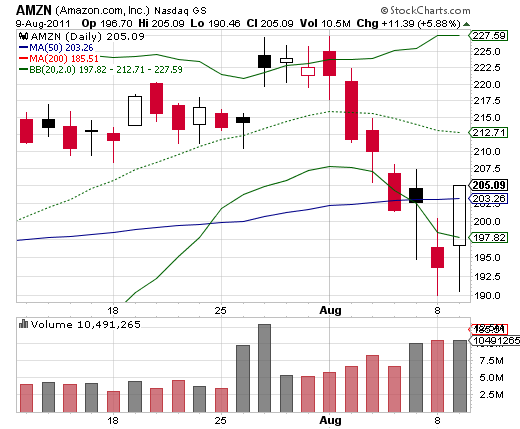

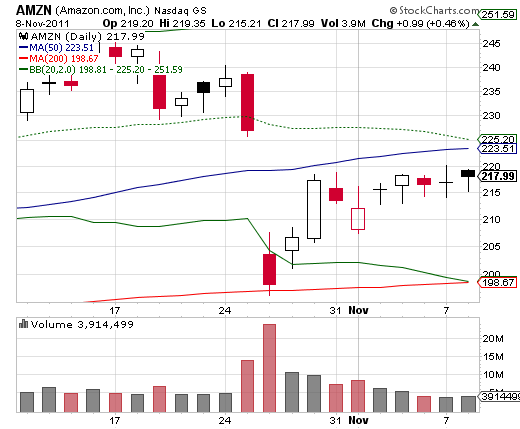

To test my casual assumptions, I reviewed the charts from the last twelve earnings reports. This range covers January, 2009 to October, 2011. I took a snapshot of the two calendar weeks before and after earnings and observed the following:

- Buying at the CLOSE of post-earnings trading resulted in gains on six occasions, losses on four occasions, and a wash on two occasions.

- Buying at the OPEN of the first day of trading post-earnings produced gains on seven occasions and losses on five occasions.

- Stopping out of a trading position once Amazon.com closed below the lows of the first day of post-earnings trading reduced losses to minimal levels and preserved all gains. In other words, when Amazon.com is racing to post-earnings gains, the lows from the first day of trading post-earnings hold as firm support.

- On six occasions, buying the open produced sizeable one-day gains by the close of trading.

These observations produced the following rule for trading Amazon.com post-earnings: buy the open and hold for at least two weeks UNLESS the stock closes below the low of the first day of trading.

{snip}

2009 Q1

2009 Q2

2009 Q3

2009 Q4

2010 Q1

2010 Q2

2010 Q3

2010 Q4

2011 Q1

2011 Q2

2011 Q3

2011 Q4

Source for charts: stockcharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 1, 2012. Click here to read the entire piece.)

Full disclosure: no positions