This is an excerpt from an article I originally published on Seeking Alpha on December 14, 2011. Click here to read the entire piece.)

In a day when debt has become a four-letter word and leverage has become a noose, it may seem odd that Cabot Microelectronics Corporation (CCMP), a supplier of chemical mechanical planarization (CMP) polishing slurries and pads, chose to reduce its cash balance and increase debt and leverage in a major “capital management initiative” that includes a leveraged recapitalization. I suspected the intricate financial engineering was designed to hide some dirty secret on the balance sheet. After all, CCMP is a heavily shorted stock with 19% of the float short. So, I turned to a knowledgeable friend of mine for answers. He explained to me that CCMP is essentially exchanging equity for debt in order to directly pay shareholders the value currently locked up in the company. In his own words with some editing for clarity:

…{snip}…

Here is a summary of CCMP’s plans from the company’s press release:

…{snip}…

The reaction in the stock was swift. CCMP closed the day with a 14.4% gain. The stock increased by as much as 26%.

Source: FreeStockCharts.com

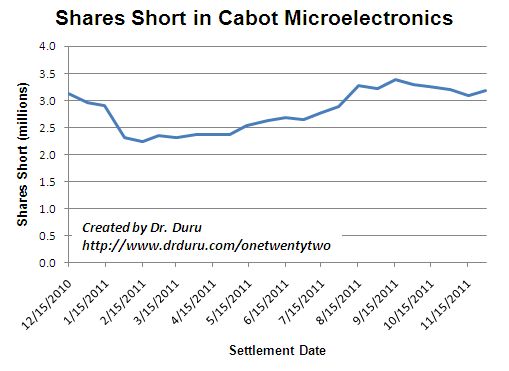

The tremendous fade in the stock suggests to me that much of CCMP’s initial surge came from short-covering. …{snip}…

Source: NASDAQ CCMP Short Interest

The overall bearish outlook on the market may yet bring CCMP’s price back down and provide golden entry points to take advantage of CCMP’s largesse. In Tuesday’s press release, CCMP even reminds investors of the business risks ahead:

…{snip}…

…I am very surprised shorts used the swoon this summer to increase bearish bets rather than close them out.

Source: FreeStockCharts.com

CCMP is a stock to watch and one to buy on the dips.

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on December 14, 2011. Click here to read the entire piece.)

Full disclosure: no positions